Confidently understand your FX risks and hedging results with ease

For a successful FX risk management program, a comprehensive analysis of all the results is an absolute requirement. AtlasFX provides easy drill-down FX results analytics that explain all the complex sources of FX variance.

Solving the Mysteries of Forex Risks -

FX risk for multi-national corporations is a complex problem to solve, and many Treasury teams struggle to understand how well they are doing in managing this risk. With AtlasFX, the industry’s most comprehensive FX risk management solution, Treasury teams gain insightful access to:

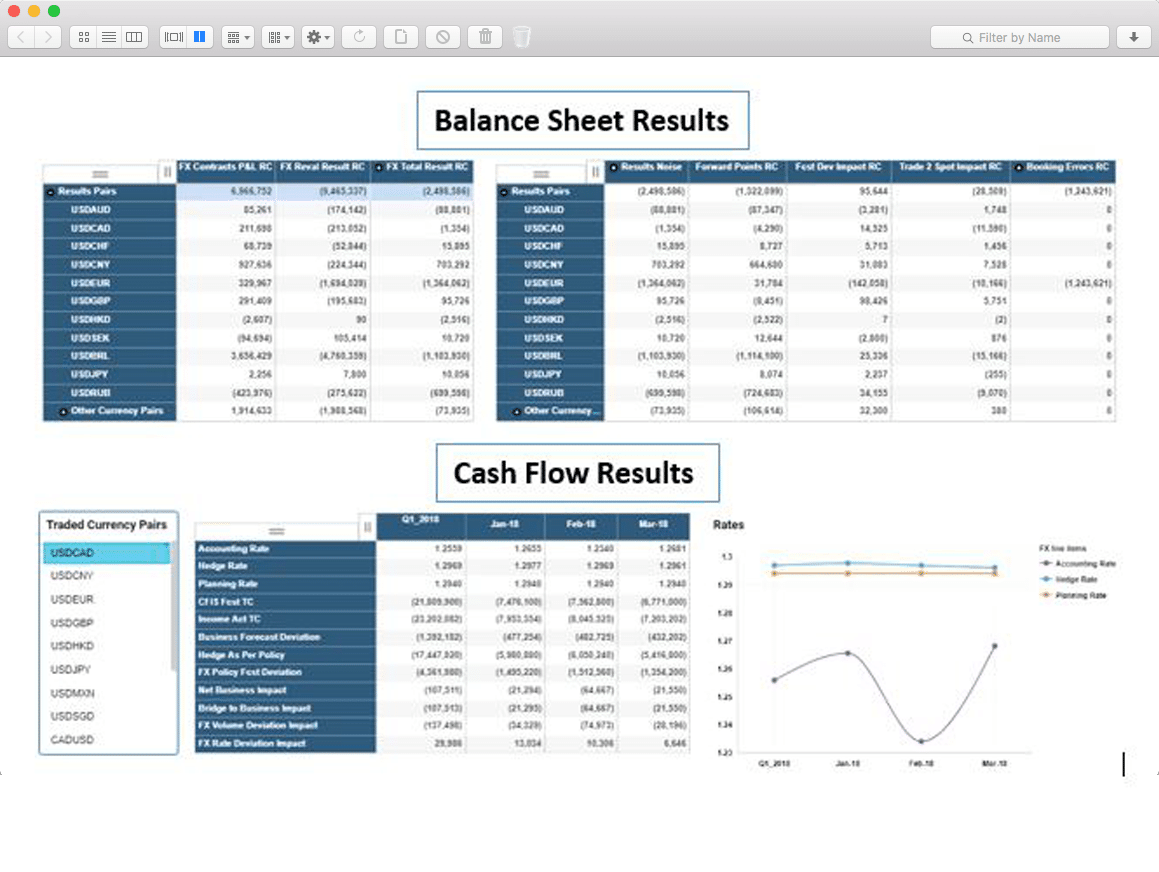

- Balance Sheet results (deltas between hedges and remeasurement).

- Cash Flow results (complete bridge to planning/budget rates).

- Counterparty and TCA analysis for optimizing FX trading performance.

Results Analytics

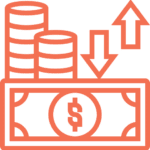

Balance Sheet

Understand the details of hedging variance, including forward points, forecast deviation, spot rate slippage and remeasurement inconsistencies.

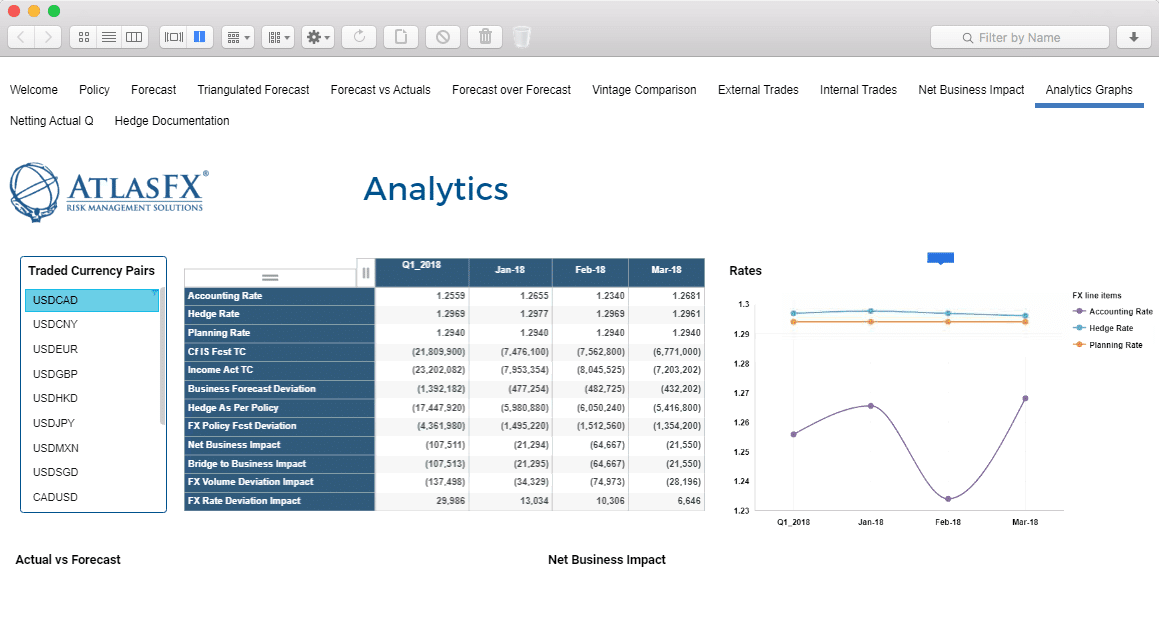

Cash Flow

Get a detailed breakdown of all the FX volume and rate drivers that bridge back to the company’s planning and budgeting metrics.

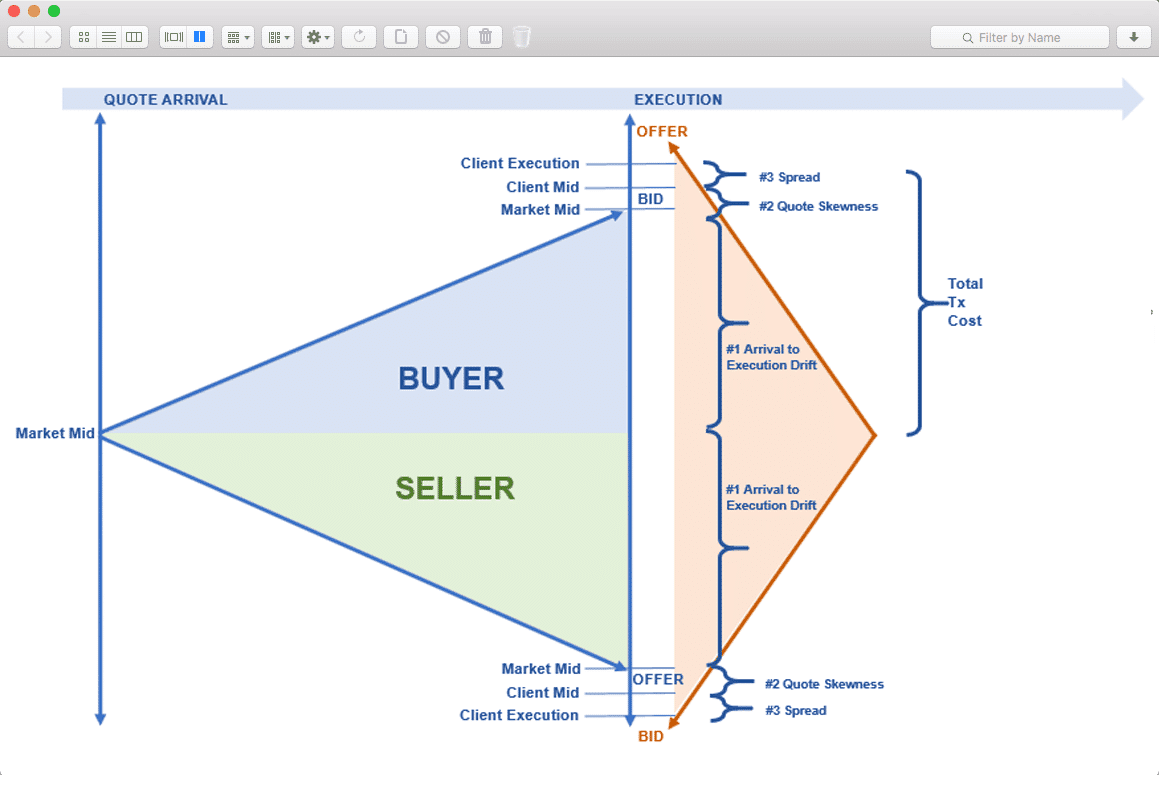

Counterparty and TCA

Stay ahead of slow credit rating updates for your bank counterparties, and concurrently get detailed Transaction Cost Analysis on your FX trades.

Balance Sheet

FX risk managers get a scorecard every month related to their balance sheet hedging results, which at a high level is merely the difference between their hedging gains/losses and the remeasurement losses/gains the hedges are meant to offset. Treasury teams often struggle explaining where this delta is coming from (other than perhaps forward point impacts) due to the lack of results analytics visibility. With AtlasFX, understand all the details of the balance sheet results variance, including spot trading impacts, forecast deviation impacts, and “booking error” or “remeasurement inconsistency” impacts. The AtlasFX balance sheet solution provides all of this for any accounting rate approach the company may utilize.

Please read “The consequences of not understanding FX results in time”– white paper for more detail.

Cash Flow

Cash flow hedging results (which for some companies may be more accurately described as income statement hedging results) are often allocated to various geographies and/or business units throughout the company. Therefore, they typically have a broader audience concerned with their accuracy and effectiveness. AtlasFX helps build the bridge back to the relevant budgets or plans that make the cash flow hedging results meaningful to the broader audience. AtlasFX provides the crucial understanding of volume drivers from both forecast deviation and hedging policy choices, as well as rate drivers from the difference between hedged rates and planning rates.

Please read “How to measure success in your Cash Flow hedging program”– white paper for more detail.

Counterparty and TCA

In September of 2008, Lehman Brothers went from being “single A” rated on a Friday to bankrupt on Monday. Yet many Treasury groups still monitor their bank counterparty credit risk based on “too slow to rely upon” credit ratings. Similarly, TCA (Transaction Cost Analysis) is one of the least developed areas of corporate treasury teams. AtlasFX helps you monitor your counterparty risk with numerous real-time metrics, while also helping to calculate the actual margin captured by your FX trading counterparties.

AtlasFX also provides “FX Trading best practices” consulting, and benchmarking against peer groups. Please read “OTC Counterparty Risk Mitigation Strategies” and “Are your FX Derivatives Executed on a Level Playing Field?”– white papers for more detail.