The foreign exchange (FX) market has the highest daily trading of all financial assets; annualized FX trading equates to an astounding 13 times global GDP. Multinational corporations are, necessarily, major participants in the FX market. In order to hedge their currency risk, these companies trade large volumes of FX-based derivatives. However, the playing field for these trades is often tilted in favor of their banking partners.

Multinational corporations usually obtain FX derivatives from banks through over-the-counter (OTC) trading. The unregulated OTC derivatives market generally offers companies the best selection of instruments, but a series of scandals in which banks have been caught gaming various OTC markets indicates that caution is appropriate.

In 2011, the Bank of New York Mellon was sued by both the New York attorney general and the United States attorney general in Manhattan for routinely overcharging customers in the processing of FX transactions. The AGs claimed that the bank defrauded clients of more than $2 billion. In the same year, State Street Bank was sued by several state pension funds and investigated by the SEC for similar allegations. A year later, it was determined that many of the largest banks were gaming LIBOR (the London Interbank Offered Rate), which underpins $350 trillion in derivatives. Some were found guilty and fined, including Barclays ($200 million) and UBS ($1.5 billion).

Then, one year after the LIBOR scandal, a systematic rigging of the WM/Reuters fixing rates was revealed. (See the sidebar How WM/Reuters Fixing Works, below.) Apparently, some major banks were front-running client’s closing spot trade orders, which were large enough to move the market. A bank would sell or buy ahead of the client, then try to move the benchmark rate in its favor. While one bank alone may not have enough reserves to substantially change the rate, the four largest banks—Deutsche, Citigroup, Barclays, and UBS—control more than 50 percent of the market. Traders at these banks would text one another to determine when client orders matched up enough to facilitate moving the fix. By making a large number of low-volume trades within the one-minute window during which the WM/Reuters rates are calculated (also known as “banging the close”), the banks could move the fix and square their positions profitably.

Price manipulation is not the only way in which banks pose risks for their foreign exchange clients. Counterparty credit risk is another concern. When Lehman Brothers moved from investment-grade credit to bankruptcy over a single weekend in 2008, the company had more than 67,000 open trades. While Dodd-Frank, Basel III, and other regulatory changes have reduced this risk by requiring banks to maintain higher Tier 1 capital ratios, multinational corporations still risk having their derivatives contracts become worthless should a bank default during times of high volatility/low liquidity.

Like any corporation, banks are the fiduciary of no one but themselves. It behooves anyone trading derivatives to do so with caution and with a defensive attitude. Fortunately, there are specific actions that a corporate treasurer can take to create transparency and safety where obfuscation and danger prevail.

GUARDING AGAINST PRICE MANIPULATION

One of the most effective methods for minimizing costs is to bid out every trade, especially every trade that is a significant size. To guard against price manipulation, multinational corporations need to establish trading relationships with multiple counterparties and ask for bids from each one. For a treasurer who’s shopping around an FX transaction or derivatives trade, it’s crucial to know where the market is. Companies should not depend on their banks for quotes of the spot rate or forward points.

Instead, you need to use independent third-party sources to determine the spot and forward prices at the time of each trade. This exposes each bank’s true bid-ask spread. Spot rates are easy to verify using services such as TrueFX, but forward points are not as easy to pinpoint.

Subscriptions to Bloomberg, SuperDerivatives, WM/Reuters FX Indices, and Interactive Brokers are not cheap, but they can pay for themselves by revealing where the market truly is. Avoiding a misquote of 10 basis points (bps) on the forward rate—which consists of the spot rate plus forward points—for a trade worth US$2.5 million per month would cover the cost of a typical subscription.

A treasurer may also want to specify that trade pricing will be tied to the WM/Reuters fixing rate. Despite the recent scandal, WM/Reuters fixing rates are the most transparent and liquid in the foreign exchange market. Specifying that trades will be priced at the WM/Reuters spot rate allows a treasurer to bid out the trade’s forward points, preventing any possibility of a skewed spot quote.

OUTSMARTING FRONT-RUNNERS

Very large corporations must make very large trades to hedge their transactional risk, and the size of those trades creates another kind of pricing risk. Very large trades can actually move the market, and large companie’s banks may be tempted to front-run their trades. Banks will usually know the direction a client needs to trade, and this may skew their bid-ask spread for the client’s trade.

A corporation can use several tactics to address this risk. The first tactic is to split the trade among several counterparties. This reduces any one bank’s visibility into the size of the overall trade, which may remove the temptation to front-run it. Tying the trade’s pricing to the WM/Reuters fixing rate and placing the trade just before the fixing period will prevent banks from communicating to determine the total size of the trade.

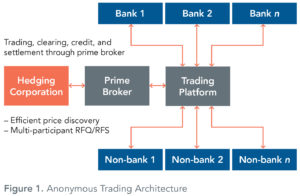

The second tactic for preventing front-running is to trade anonymously with multiple liquidity providers. This can be achieved through the use of a prime broker and a trading platform, such as FXall or 360T. In this type of transaction, the prime broker places the corporate order anonymously through the trading platform, which automatically queries the market for the best pricing. Banks and non-bank FX providers such as Alpha Global Exchange and Infinity International can respond to a request for quote (RFQ)/request for spread (RFS). See Figure 1.

TAKING ADVANTAGE OF EXCHANGES

OTC derivatives usually serve corporate hedging needs better than exchanges because they enable the company to set tenors and notionals with precision. (See OTC vs. Exchange-Based Trading, below.) However, savvy corporate treasurers use the futures market in two ways. The first way is through exchange-based trading; when a company’s desired notionals and tenors match the size and expiries of available instruments, trading on an exchange offers much lower counterparty risk and more pricing transparency.

The Chicago Mercantile Exchange (CME) recently developed a hybrid facility that offers some of the benefits of exchange-based trading while preserving some of the flexibility of the OTC market. Essentially, the CME allows for a variety of OTC trades to be settled and cleared through the exchange. This eliminates bank counterparty risk because the CME becomes the counterparty. Thirty-eight currency combinations are eligible for trading through this service, and maturities can be any valid business day between spot and two years. Both the bank and the corporate FX client have to agree to use the CME service, of course.

The second way in which exchanges can help corporate treasurers is by creating pricing transparency in the OTC market. Exchange-traded derivatives usually expire on the third Wednesday of the month. The value of a future and a forward of the same expiry must converge, or else there would be an arbitrage opportunity. If a treasurer specifies that his OTC trades should expire on the third Wednesday of the month, the OTC prices that banks quote should match the exchange pricing, thus creating pricing transparency.

CONTROLLING COUNTERPARTY RISK

International Swaps and Derivatives Association (ISDA) Master Agreement is the cornerstone of any transactional relationship between two parties engaged in OTC financial transactions. (See ISDA Key Components, at right.) It should come as no surprise that ISDAs between corporations and banks have traditionally been rather one-sided. If a company’s credit rating is downgraded beyond a certain level, its banking counterparty will notify it that it has triggered the terms of its CSA and that it needs to post additional collateral. But even if a bank actually defaults on a corporate customer, the company will likely have no opportunity to collect any collateral.

For example, a typical CSA might call for the exchange of collateral if either party’s credit rating is BBB or lower. The company may be able to operate for quite some time with a BBB rating, or even at a below-investment-grade level. If the company’s credit rating were to drop to BBB, the bank would have ample opportunity to obtain collateral under this CSA. However, if a major bank’s credit rating fell to BBB, that would likely be the straw that broke the camel’s back. The bank would no longer have sufficient capital to post collateral, and its cost of funds would have already increased to a level that makes operating as a bank problematic. The bank would be much more likely to default at this same credit rating, so a CSA with these terms would provide a false sense of security to the corporate counterparty. What can a corporate treasurer do to level the credit-risk playing field? First, it’s imperative to monitor counterparty exposures on a timely basis and to set triggers for action. These triggers should be based onreal-time indicators of a bank’s risk of default, such as its level of credit default swaps (CDS). As the bank approaches the limits you’ve set, reallocate your short-term trades and/or cash deposits as much as possible.

For longer-term exposures, such as cross-currency interest rate swaps or long-dated forwards, consider posting margin utilizing the services of a third-party collateral manager. Collateral managers accept and remit collateral based on the mark-to-market status of the outstanding trades to each financial counterparty. Companies and their banks need to spell out in their CSAs both the role of the collateral manager and the objective measures of risk that will be used to set collateral requirements for both parties.

LIMITING BANK’S RE-HYPOTHECATION RIGHTS

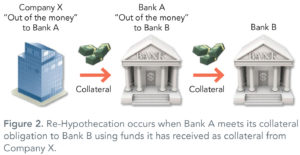

One other approach to reducing the counterparty risks posed by banks is to limit their re-hypothecation rights. Figure 2, below, demonstrates how re-hypothecation works. In the illustration, Company X is required to post collateral because it is out of the money on a series of trades with Bank A, its counterparty bank. Bank A, in turn, is out of the money with respect to some transactions it’s engaged in with Bank B. So at the end of the day, Bank A must post collateral to Bank B. Rather than coming up with its own funds to use as collateral, Bank A prefers to cover its agreement with Bank B by “re-hypothecating” the collateral it receives from Company X.

For Company X, this arrangement can be highly problematic if Bank A is at risk of default. If the trades happen to move back in Company X’s favor, Bank A may no longer have the funds to return Company X’s collateral. Rules have been very loose in governing how banks can re-hypothecate collateral, under the argument that it frees up capital and makes lending cheaper. Unfortunately, this has resulted in some circumstances where multiple counterparties have claims on the same collateral. In the bankruptcy of MF Global, for example, untangling the complex trail of commingled assets and collateral claims took years.

Whether or not to grant your banking counterparties re-hypothecation rights on the collateral you might end up sending them is an item for negotiation. If you do not grant re-hypothecation rights, the bank will likely add to the trade a funding charge, which may be significant. One Fortune 100 treasury manager, with whom we recently discussed this issue, noted that the funding charge his company faced during negotiations would have been prohibitively expensive, so although the company considered its options, in the end it granted re-hypothecation rights to its counterparty.

ADOPTING A DEFENSIVE POSTURE

Because it is largely unregulated, the over-the-counter market for FX derivatives is full of hidden and costly traps that threaten to catch up unsuspecting corporate treasurers. Tactics companies might encounter from their banking counterparties include outright price misquotes, skewed bid-ask spreads, front-running of large trades, asymmetric ISDAs and CSAs, and re-hypothecation.

Fortunately, multinational corporations have a number of options for leveling the playing field. All treasurers engaging in derivatives trades should obtain accurate and unbiased market information, and should bid out large transactions. Once they know where the market is, treasurers can consider splitting trades among multiple counterparties or trading anonymously to prevent front-running. They can time their OTC trades to coincide with CME maturity dates and the WM/Reuters fixing schedule. They can negotiate CSAs that are more fair. They should monitor their bank’s credit ratings along with their exposure to the banks, and they should consider utilizing third-party collateral managers. A corporate treasury team that uses these tactics in its FX derivatives trading dramatically reduces its risk of being overcharged or caught flat-footed by credit issues among its banking counterparties.

About the Author

Atlas founder and Chief Investment Officer, Jonathan (Jono) Tunney, brings deep and broad expertise to bear on global economic analysis, asset allocation, business valuation, portfolio design, and risk management. His experience includes responsibility for worldwide currency risk management and more than $100 billion in annual foreign exchange transactions as Director of Foreign Exchange for Hewlett Packard. He also has experience in treasury, corporate finance and strategic planning, including valuation, deal structuring and negotiations for equity investments and acquisitions, and tax strategy and dividend policy analysis. He holds a BA in Economics and Political Science from Stanford University, an MBA in Finance from the Anderson School at UCLA, and the Chartered Financial Analyst Designation.

Disclaimer

The information contained in this publication is provided for information purposes only. The information contained herein has been obtained or derived from public sources believed to be reliable, but we do not represent that it is accurate or complete and should not be relied upon as such. Any opinions or predictions constitute our judgment as of the date of this publication and are subject to change without notice.

All rights reserved. Please cite source when quoting.