There are few decisions that have as far reaching an impact on your foreign exchange accounting and hedging as the chosen accounting rate methodology. The accounting literature that addresses this topic, FAS 52, was written in 1981 and unfortunately addresses this in a rather clumsy way. Paragraph 16(a) states that when a foreign currency item is recognized, it “shall be measured initially in the functional currency of the recording entity by use of the exchange rate in effect at that date”.

Given the millions of transactions that multinational companies deal with every month, applying this standard can be a nightmare, which the FASB apparently recognized and addressed in paragraph 29 of FAS 52.In this paragraph, they admit that the literal application of this standard could be “burdensome as wellas unnecessary to produce reasonable approximations of the results. Accordingly, it is acceptable to use averages or other methods of approximation”.

Well, thanks for that. Start off specific but theoretical, acknowledge it’s impractical, and then end with vague. Perhaps whoever was writing this standard in 1981 for the FASB was getting paid by the word. Over thirty years later, interpretations of this standard vary considerably, and there is no single accounting rate setting methodology used by even a majority of companies. Roughly 90% of corporations, however, seemed to have settled on one of three methodologies:

- The daily actual spot rate – transactions are booked at the market rate on the day they occur.

- The monthly average rate – transactions are booked at the simple average rate over the month.

- The prior month end spot rate – transactions are booked at the prior month’s remeasurement rate.

Is there one methodology that is better than the others?

To attempt to answer this question, we need to think about how this decision affects other activities in the organization. While there are many far reaching ramifications, such as the complexity of accurately tracking these details in the company’s ERP system(s), we’ll specifically focus on the income statement impacts, the FX remeasurement impacts, and impacts on the FX hedging process.

IMPACT ON FINANCIAL STATEMENTS

Regardless of the rate used to represent foreign currency transactions in Converted Local Currency (CLC), these numbers will need to be remeasured at the month end closing rate for mark-to-market purposes. Any difference between the CLC value of the monthly transaction and the CLC month end balance will result in a FAS 52 remeasurement P&L impact, which is typically found in the Other Income & Expense (OI&E) line of the Income Statement. It’s important to note that the month-end values of balance sheet items are unaffected by the methodology for determining their CLC values and therefore the accounting rate setting methodology will not affect ending book value.

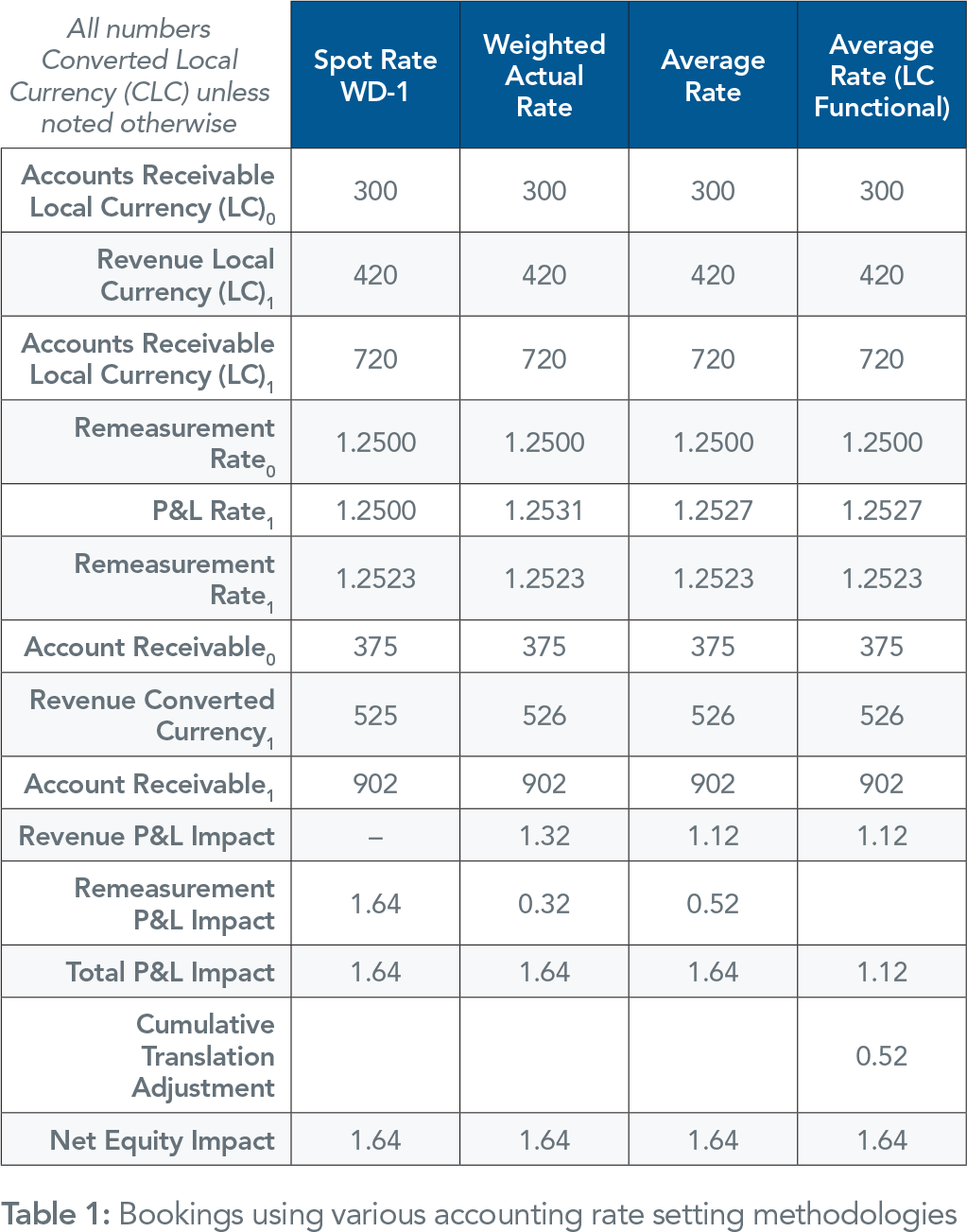

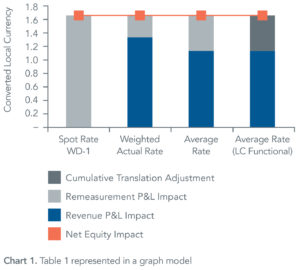

Table 1 shows the different bookings using the various accounting rate setting methodologies. In this example (and hereafter) we’ll assume that local currency revenues (and receivables) are the dominant exposure being hedged, but the same would apply for expense (and liability) hedging as well.

Notably, while net equity impact is the same, the transactions that accumulate to net equity impact will appear in different areas depending on the accounting rate methodology selected. In general, the earlier the P&L rate is finalized, the less volatility will be realized on the “above the line” portion of the income statement due to currency movements and the more volatility will be realized in OI&E. Most companies would prefer stability in the revenues and expenses and would better tolerate variance in OI&E.

Notably, while net equity impact is the same, the transactions that accumulate to net equity impact will appear in different areas depending on the accounting rate methodology selected. In general, the earlier the P&L rate is finalized, the less volatility will be realized on the “above the line” portion of the income statement due to currency movements and the more volatility will be realized in OI&E. Most companies would prefer stability in the revenues and expenses and would better tolerate variance in OI&E.

One might be tempted to conclude that it’s best to keep the accounting rate methodology that determines the initial value as simple as possible, which is certainly an argument for using the “prior month end spot rate” method. Unlike the other two methods, this one uses a single rate per month and the rate is known at the beginning of the month. Given its widespread use, it has clearly been successfully argued as having met FAS 52’s vague criteria, as well as representing a sufficient approximation over time (three rates per quarter, twelve per year).

Why, then, do so many companies currently use either the actual daily spot rate method or the monthly average rate method? More than likely, this decision is made early in a company’s existence, before they have the desire (and Treasury infrastructure) to forecast and hedge their FX exposures. They may feel it is safest to use a smoothed out accounting rate and avoid using a potential “off market spike”.

It is not uncommon for a company to change their accounting rate methodology over time, however, and the most common time to make a change is when the company begins to hedge their FX exposure. At this point, the potential arguments for the daily spot rate or monthly average rate method weaken considerably, making the decision to change to the prior month end spot rate methodology a sound one. Unfortunately, too many companies continue to stick with the methodology they started with, making their FX hedging unnecessarily complicated.

IMPACT ON FX HEDGING PROCESS – DAILY TRADING AND REVENUE AT RISK

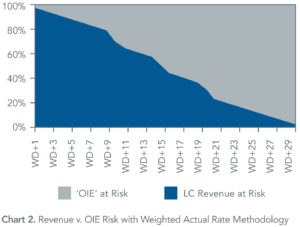

To hedge your balance sheet precisely under the daily spot or monthly average methodologies, you must either use average rate forwards (expensive) or trade every day (impractical). Furthermore, as noted in Chart 2 to the right, the “above the line” P&L is fully at risk at the beginning of the month while the P&L rate is gradually being set.

IMPACT ON FX HEDGING PROCESS – THE FAS 52 TO FAS 133 “HANDOFF”

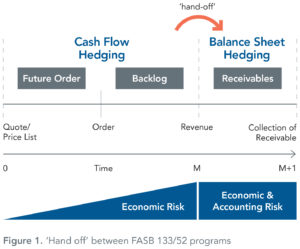

Complications associated with daily spot rate or monthly average rate methods impact both FAS 133 and FAS 52 hedging. Once a company embarks on a FAS 133 hedging program, they can effectively smooth out their revenue and expense impacts from currency movements. A layered hedging program achieves this quite well, and as long as the company understands their foreign currency risk factors, they can convert a proper percentage of their future exposures over time and incorporate their weighted average hedged rates into their plans.

However, FAS 133 hedges are most easily closed out (and ideally, integrated into the FAS 52 hedging process) if the prior month end spot rate methodology is used. The portfolio “handoff” between the FAS 133 exposure and the FAS 52 hedging is clean and simple, and can be managed with a simple forward contract executed on the day the accounting rates are set, as that single date will be the basis for the next month’s FAS 52 exposure.

When daily spot rates or monthly average rates are used, closing out the FAS 133 hedges and managing the handoff to the FAS 52 hedging program is more cumbersome as a portion of the monthly exposure moves from one category to the other each day of the month. The result is either daily trading (high administrative burden and trading costs) or a timing mismatch between the underlying exposures and their hedges to avoid daily trading. A less common response is the use of average rate forwards for hedging, which are very inefficient (in other words, very profitable for banks).

It’s important to note that there are “best practice” techniques that can be used in any accounting rate environment, but many companies fail to find the optimal solutions when the environment is complex. Unfortunately, many companies give up on forecasting their forward looking balance sheet exposure when using a complex accounting rate methodology. They merely assume their current balance sheet exposure will equal their future exposure, which is poor risk management and can negatively impact the bottom line during periods of high FX volatility.

IMPACT ON FX HEDGING PROCESS – RESULTS ANALYSIS

Perhaps one of the most daunting tasks in a large multinational corporation is to analyze month end hedging results. One of the most useful shortcuts to determining the validity of FASB 52 impacts is to calculate expected remeasurement and compare that number to actual remeasurement.

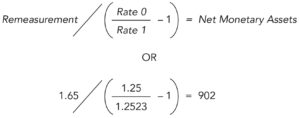

If we reference our example in Figure 1:

This example looks valid as 902 is our reported CLC balance for accounts receivable. If these numbers are NOT equal, there have probably been manual bookings in the remeasurement account or elsewhere on the general ledger which may merit further investigation.

This example looks valid as 902 is our reported CLC balance for accounts receivable. If these numbers are NOT equal, there have probably been manual bookings in the remeasurement account or elsewhere on the general ledger which may merit further investigation.

Needless to say, this check is far more difficult when using other accounting rate methodologies because the remeasurement number divided by the change in the remeasurement rates no longer equal the month end net monetary assets.

In conclusion, if your company is at the stage where you are evaluating your accounting rate methodology, there are many factors that should convince you to use the prior month end spot rate alternative. There is no benefit to an accounting rate methodology that uses more data points or requires averaging once you begin to hedge. In fact, when you decide that you want to control your hedged results, any methodology that creates unnecessary complexity and expense should be avoided.

About the Authors

Jonathan E. Tunney, CFA

Jonathan (Jono) Tunney’s experience includes responsibility for worldwide currency risk management as Director of Foreign Exchange for Hewlett Packard. He holds a BA in Economics and Political Science from Stanford University, an MBA in Finance from the Anderson School at UCLA, and the Chartered Financial Analyst designation.

Scott Bilter, CFA

Scott has held a number of executive positions with Hewlett Packard, including VP of Corporate Finance and Foreign Exchange, and VP of Worldwide Financial Planning and Analysis. He holds a BA in quantitative Economics from Stanford University, an MBA in Finance from the Anderson School at UCLA, and the Chartered Financial Analyst designation.

Disclaimer

The information contained in this publication is provided for information purposes only. The information contained herein has been obtained or derived from public sources believed to be reliable, but we do not represent that it is accurate or complete and should not be relied upon as such.Any opinions or predictions constitute our judgment as of the date of this publication and are subject to change without notice.

All rights reserved. Please cite source when quoting.