- Posted on

- Developer Team

- 0

Not all FX solutions are equal: 10 reasons to choose AtlasFX for FX risk management

When you’ve decided to implement an FX risk management solution instead of building one in-house, the next challenge is choosing the right vendor.

What you might not know is how dramatically the right solution can impact your bottom line. Many FX platforms promise to streamline workflows but leave critical gaps, forcing you to rely on manual processes or multiple vendors.

AtlasFX is different.

Built by FX practitioners, for FX practitioners, AtlasFX offers unmatched capabilities that simplify workflows, improve forecasting, and empower Treasury teams to operate with confidence.

Here’s why AtlasFX is the ultimate choice for your FX risk management needs.

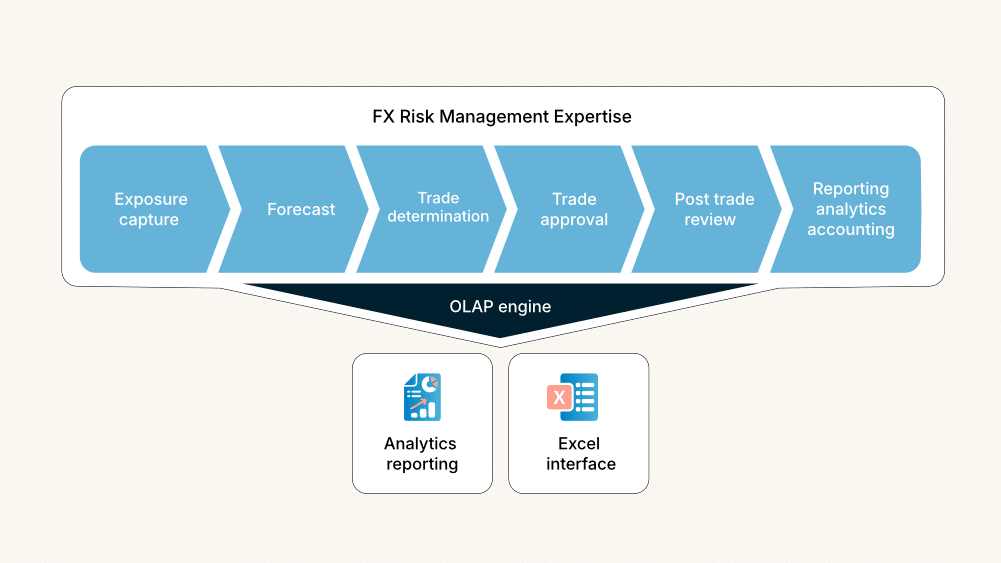

1. Complete FX workflow

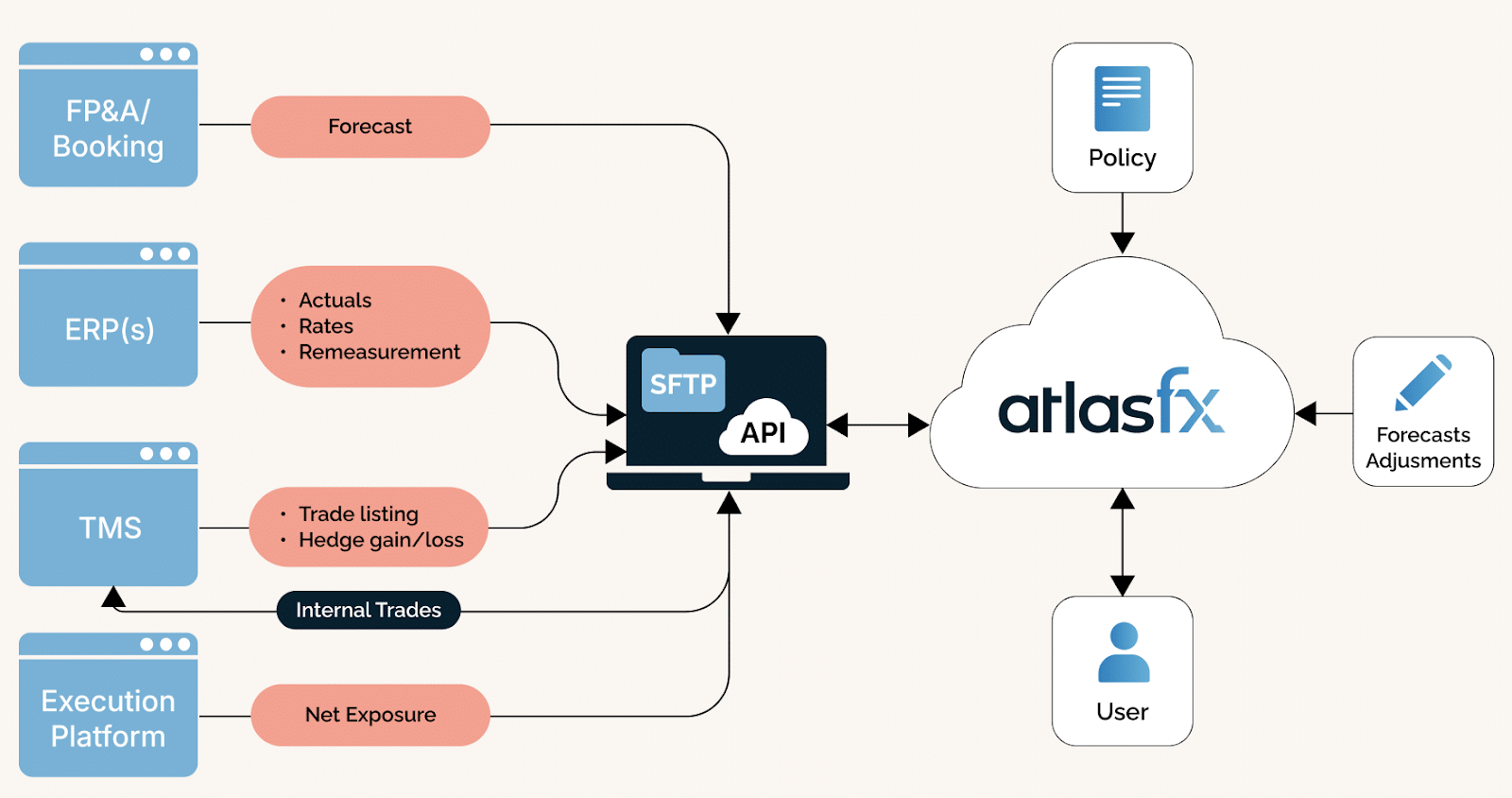

AtlasFX is the only true end-to-end FX risk management platform, connecting all relevant systems such as ERPs, TMS and execution platforms.

The workflow incorporates the pre-trade tasks of aggregation of the data, forecasting and approval, and post-trade review. It’s designed to cover all the monthly tasks in the FX process including hedging, ad-hoc trades, netting, and rollover of trades.

Other vendors will only do a subset of this workflow, leaving clients to bridge the gaps with manual processes.

2. Seamless ERP integration

AtlasFX integrates with all the leading ERP systems, while our scripts take the balance sheet exposures and the income statement in the transaction currency.

The reports are dynamic in that if there are new accounts or entities added to the ERP, and they contain exposures, they’ll be automatically added to the report. With other vendors, this process is manual and often gets neglected, so the data becomes incomplete over time.

The income statement is extremely important when it comes to cashflow forecasting, as well as understanding what drives the balance sheet—since revenues become receivables and expenses become payables.

3. Automated connectivity

AtlasFX fully automates the data load from the ERP systems, and you’ll have a dashboard to see which ERPs have integrated, and what time they updated.

AtlasFX also integrates with all leading TMS systems and aggregates the trade listings and trade gain loss information. It also sends approved trades to the leading multi-bank execution platforms via API.

This level of automation significantly reduces manual effort and ensures accurate, up-to-date data.

4. Reliable deployment

Unlike other companies who often outsource deployment, AtlasFX handles 100% of the deployment in-house. We do not outsource to other vendors.

Our team works closely with your organization, even going onsite to fully understand your requirements. We plan and configure the deployment of Atlas FX exactly the way you want it.

Other vendors will outsource deployment, won’t do onsite visits, and will try to deploy their standard offering. This personalized approach allows us to configure AtlasFX to fit your unique needs, rather than forcing a one-size-fits-all solution.

5. Tailored customization

No two organizations have the same FX risk management requirements, which is why AtlasFX offers unparalleled configurability.

While other vendors have a very rigid and fixed structure when it comes to forecasting and workflow, we adjust our setup to match the requirements of your programs.

Some of the configurations we customize include:

- Multiple ERP systems

- Accounting rate methodology

- Netting of exposures

- Maturity dates of trades

- Functional currencies

- Ad-hoc trades

- Forecasting levels

6. Forecast excellence

Proper FX risk management typically requires forecasting details beyond what may already be available.

For example:

- FP&A may forecast by region and by quarter, but Treasury needs it by month and by currency pair

- FP&A may ignore intercompany activity that nets to zero, but Treasury needs this to manage FX risk specific to each entity

- Lastly, balance sheet forecasts by entity and currency may not exist at all

AtlasFX bridges these gaps by providing comprehensive historical data alongside these crucial details to assist in manual forecasts. We can also feed this data set into several AtlasFX AI models, saving time and improving accuracy.

AI is perfectly suited to this task, which can involve forecasting hundreds of currency pairs and entity combinations—well beyond what Treasury teams can accomplish manually

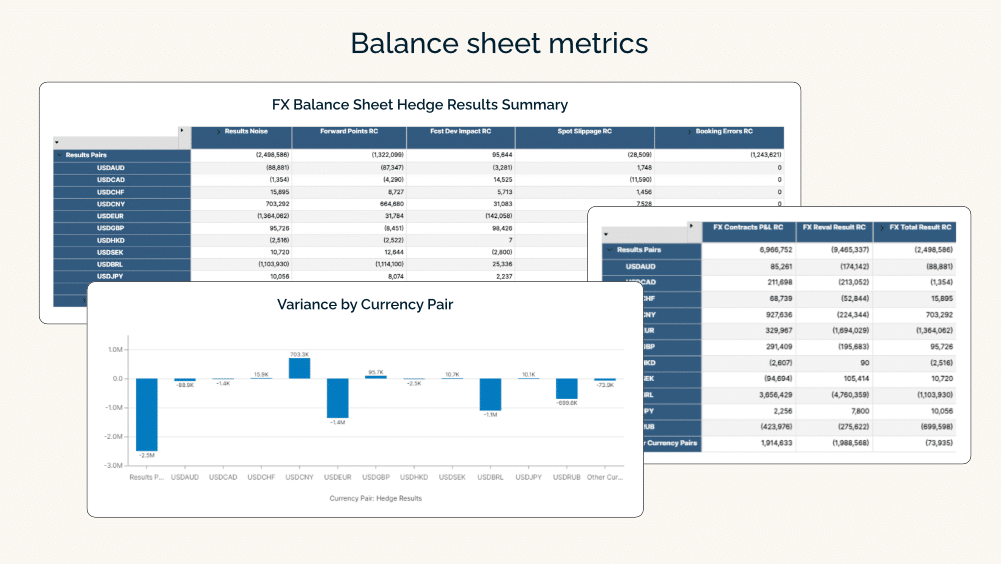

7. Robust analytics

When it comes to your month-end results and analytics, AtlasFX will show the source of all the noise in the results.

If it’s on the balance sheet side, we’ll tell you how much was paid in forward points, what the forecast deviation impact was, and how much of an impact the slippage between your internal rate and the execution rate has been.

We’ll also pick up any differences or inconsistencies in the accounting. For example, if somebody books a journal at the incorrect rate, that will be called out. Any “ghost balances” on the balance sheet can also be identified.

On the cash flow hedging side, we’re able to show how well the program is performing against the plan, bridging what is often a major gap between FP&A and Treasury. Forecast deviation analysis on relevant volumes and rates, constant currency comparisons, and ability to perform scenario analysis on multiple variables all help keep Treasury and FP&A on the same page.

This is key to any hedging program and is not something covered by other vendors.

8. Powerful reporting

AtlasFX offers a powerful reporting suite, allowing users to create, save, and share custom reports through an Excel add-in.

This flexibility eliminates the need for costly professional services and puts actionable insights at your fingertips. You can slice and dice information, create, save, and share reports with colleagues. Whether you need detailed analytics or a quick snapshot, AtlasFX simplifies reporting for every user.

9. FX domain expertise

A key distinction of ours is the deep expertise our team offers in FX risk management. We’re not just an IT company—we’re FX risk practitioners at heart, with decades of experience on the corporate side.

AtlasFX’s cutting-edge technology was created by foreign exchange professionals, for foreign exchange professionals. This expertise ensures that every feature and functionality is tailored to the real-world needs of Treasury teams.

10. Unparalleled service and support

At AtlasFX, customer service isn’t an afterthought—it’s a core differentiator.

Professional services are included in the subscription so that all adjustments, changes, and updates are covered. There’s no need to look for any additional budget during the year, which we recognize is often an issue for treasury functions. Other vendors charge expensive professional services for changes and updates.

Our support team is highly responsive, with SLAs in place and a full feedback loop to make sure that the support and service that’s provided meets the client’s expectations.

Why choose AtlastFX?

AtlasFX isn’t just another FX risk management platform; it’s a comprehensive solution built to transform the way you manage foreign exchange.

From seamless ERP integrations to advanced analytics and forecasting powered by AI, AtlasFX empowers your team with tools designed for precision and efficiency. Unlike other vendors, we offer deep customization, expert guidance, and a true partnership to ensure success.

To see AtlasFX in action, check out our Top 10 Reasons AtlasFX is Different video and contact us today.