Why AtlasFX

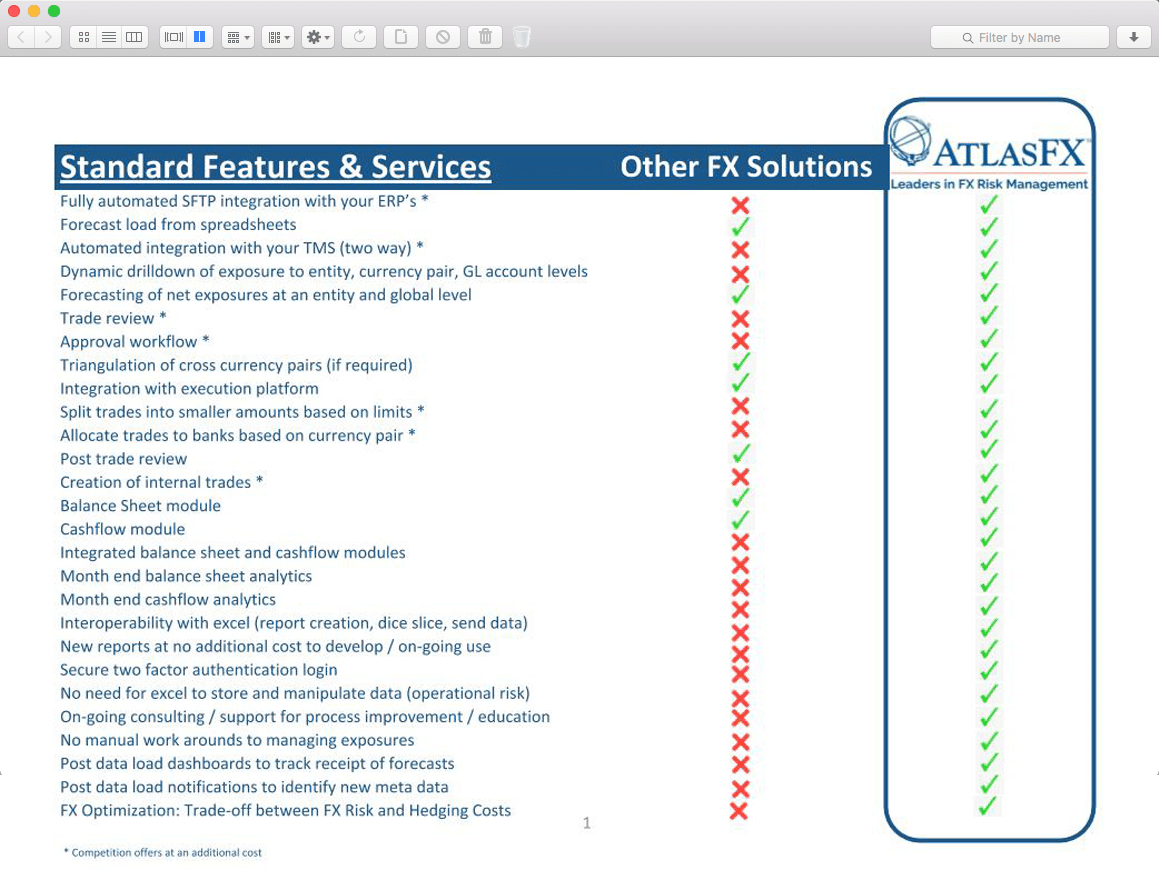

AtlasFX, the leader in FX risk management delivers an industry leading SaaS platform that identifies and mitigates all sources of FX risk. AtlasFX is used by treasury departments to optimize their balance sheet and cash flow hedging programs, including in-depth results analytics. Unlike other treasury solutions, AtlasFX provides:

- Total end-to-end FX risk management workflow

- A flexible solution, built by corporate practitioners

- Outstanding customer service

Why choose AtlasFX

Combination of consulting and technology for a scalable end-to-end foreign exchange risk management solution to defend against FX volatility.

Risk reduction

Improve forecasts, understand all sources of variance

Operational efficiency

Automate what is manual, optimize workflow

Business continuity

Lean on AtlasFX when experiencing employee turnover

Save money

Reduce FX trading costs, consulting included

The AtlasFX difference

AtlasFX is a powerful and configurable SaaS platform that optimizes the entire FX risk management workflow to reduce FX risks. Our team of experts invests time to understand all aspects of FX challenges the treasury teams face, and create a flexible and optimized solution, incorporating our domain expertise and best practices.

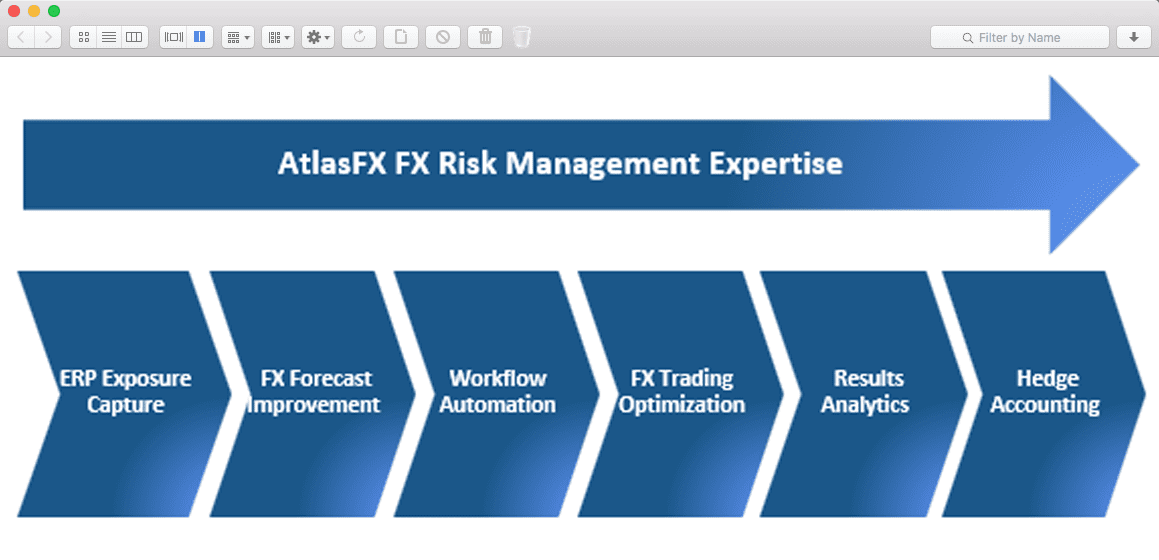

End-to-end FX risk management

While many Treasury solution providers address only a portion of the FX risk management process, AtlasFX covers the entire workflow. Our complete end-to-end integrated FX risk management solution includes the following:

- ERP exposure capture – Quickly and easily capture and manage your FX exposures.

- FX forecast improvement – Significantly reduce FX related forecast deviation.

- Workflow Automation – Completely streamline FX risk management.

- FX Trading Optimization – Efficiently optimize all aspects of your FX trading.

- Results Analytics – Thoroughly understand your hedging results and sources of variance.

- FX Accounting – Confidently close the books with FX accounting reports.