In the complex world of financial risk management, the selection of the right tools can make a significant difference, specifically in managing foreign exchange (FX) risks. AtlasFX, a specialized solution dedicated to managing FX risks, has been gaining attention for its superior capabilities when compared to traditional Enterprise Resource Planning (ERP) and Treasury Management Systems (TMS).

In this blog, we will explore how AtlasFX delivers a more effective and user-friendly approach to FX risk management.

1. Laser Sharp Focus on FX Risk

The primary advantage of AtlasFX over ERP and TMS systems is its specialized focus on FX risk management. While ERP and TMS systems offer broad financial functionalities, covering everything from accounting to liquidity management, they often lack the depth required for the intricate details of FX risk management.

AtlasFX, on the other hand, is specifically designed to address and mitigate the complexities of FX risk, providing tools that are fine-tuned to this domain’s specific needs.

2. Exposure and Gain/Loss Reporting

The AtlasFX team simplifies the process by providing scripts to extract the correct foreign currency exposure data from the ERP. These scripts generate reports that include the balance sheet and income statement in the transaction currency. Within AtlasFX, this information is available at a currency pair, entity, and GL account level at an aggregated level plus with drill-down to the lowest level.

Additionally, reports include the remeasurement/revaluation gain/loss at the same level (currency pair, entity, and GL account) and drill down capabilities.

Such comprehensive reporting is not typically offered by ERP systems, and TMS systems usually lack this depth of information.

3. Comprehensive Analytics

AtlasFX provides comprehensive analytics, which are essential for effective FX risk management, offering detailed exposure analysis, forecasting, hedging recommendations, and the ability to track the hedge program’s effectiveness. ERP and TMS systems typically handle data processing at a transactional level. AtlasFX’s aggregates data in a way that allows the treasury team to identify the sources of noise in their hedging programs.

4. Configurable

AtlasFX supports a wide range of hedging strategies and processes as no two companies have the same approach to managing FX risk. ERP and TMS systems, in contrast, can offer limited flexibility to tailor strategies to specific corporate policies or processes.

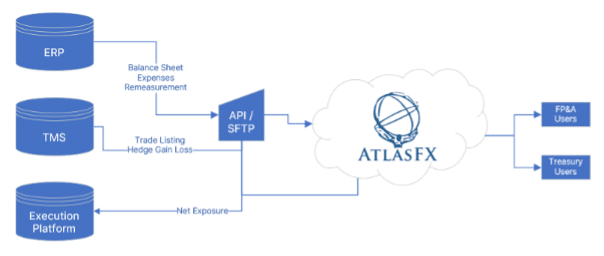

5. Integration and Scalability

AtlasFX seamlessly integrates with existing financial systems, including ERP and TMS, to enhance rather than replace foundational systems. Seamless integration allows for the aggregation of exposure data across different systems, providing a holistic view of FX risks.

AtlasFX’s scalable design accommodates business growth, easily adding new entities, GL accounts and currency pairs. ERP and TMS systems can sometimes be rigid, requiring significant customization or additional modules to manage FX risk effectively as the company grows.

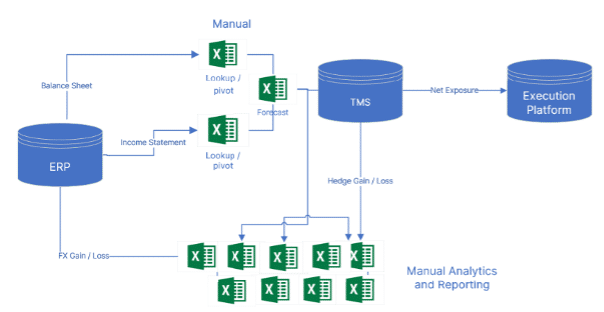

Figure 1. A typical FX environment using just ERP and TMS systems

Figure 2. A typical FX environment integrating the ERP and TMS with AtlasFX

6. User-Friendly Interface and Customization

AtlasFX users can configure dashboards and reports to match their specific needs, enhancing usability and ensuring that they have easy access to the most relevant information via BI and excel interfaces. ERP and TMS systems often have complex interfaces that can be challenging to navigate, especially for users who are only dealing with FX risk management occasionally.

7. Operation Risk from Excel

The gaps in the functionality offered by the ERP and TMS systems often forces treasury functions to manually bridge with Excel. The operational risks and constraints of excel are well documented. AtlasFX is a robust solution containing all the FX forecasting, workflow and reporting needed for effective risk management.

8. Dedicated Support and Development

Users of AtlasFX benefit from a team that understands the nuances of FX risk and is committed to evolving the platform to meet emerging challenges. ERP and TMS providers, offering a wide range of functionalities, might not be able to dedicate the same level of resources or attention to the specific area of FX risk management.

Conclusion

For businesses focused on managing FX risk effectively, choosing a specialized tool that’s tailored to their needs is crucial.

AtlasFX offers a comprehensive, integrated, and user-friendly solution that addresses challenges specific to FX risk management. It outshines ERP and TMS systems by providing analytics, advanced forecasting solutions, superior integration capabilities, and dedicated support tailored to the world of corporate foreign exchange. Companies employing AtlasFX can anticipate not only improved risk mitigation but also enhanced operational efficiency, making it a wise choice for modern enterprises aiming to minimize the impacts of FX volatility.