Reduce FX forecast deviation significantly with AtlasFX

Many companies struggle with poor FX forecasts, especially when it comes to forecasting their balance sheet exposure. Reduce your FX forecast deviation notably by utilizing AtlasFX, which combines best-practice FX risk management processes with key data insights that are easy to implement and configurable.

Better forecasts lead to better results -

Companies rely on forecasts that are not particularly well thought out and do not take into consideration the main drivers of balance sheet fluctuations. With AtlasFX, companies can significantly improve their forecasted FX exposures, using:

- A build methodology combining detailed exposures with key forecasted items.

- Seasonality trends incorporating monthly, quarterly and annual trends.

- Forecasting KPIs providing a feedback mechanism necessary for improvement.

FX forecast improvements

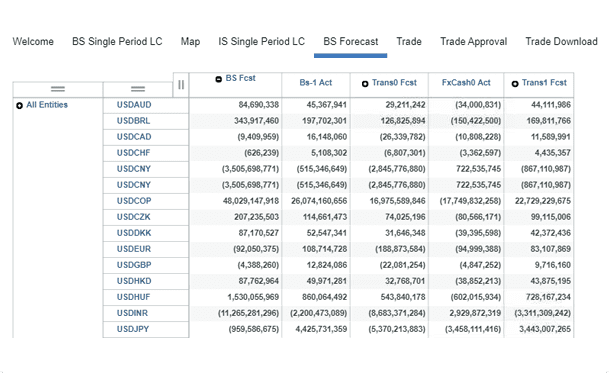

Build methodology

Leverage existing income statement forecasts that can help forecast the future balance sheet in a predictable and more accountable manner.

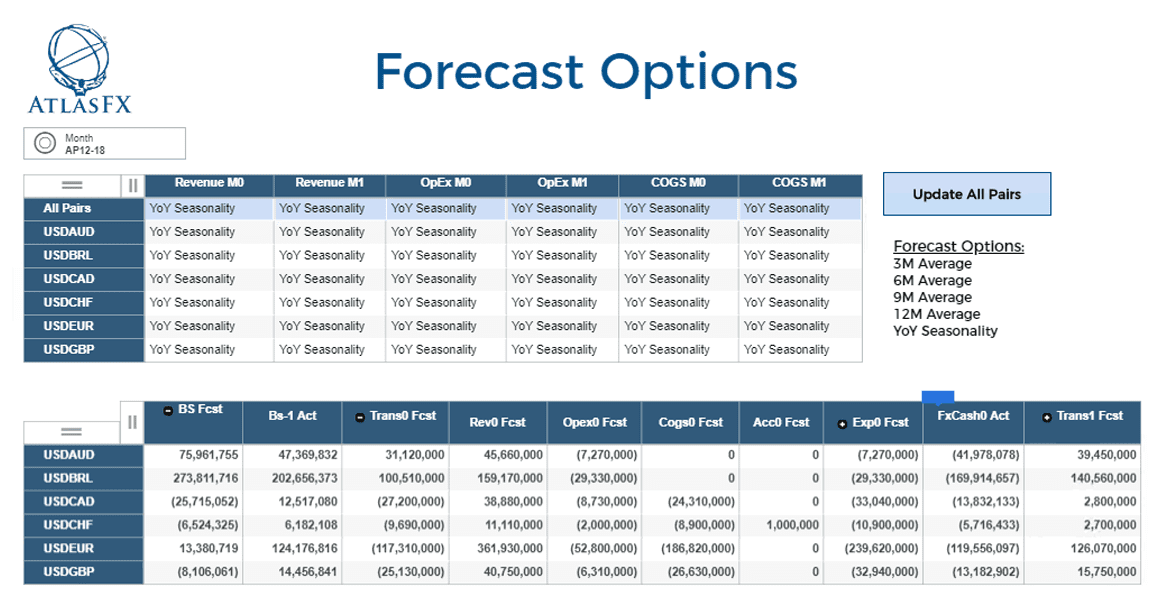

Seasonality trends

There are often predictable variations to a company’s FX exposures due to seasonality, from repeating revenue trends to internal end of period tax accrual true-ups.

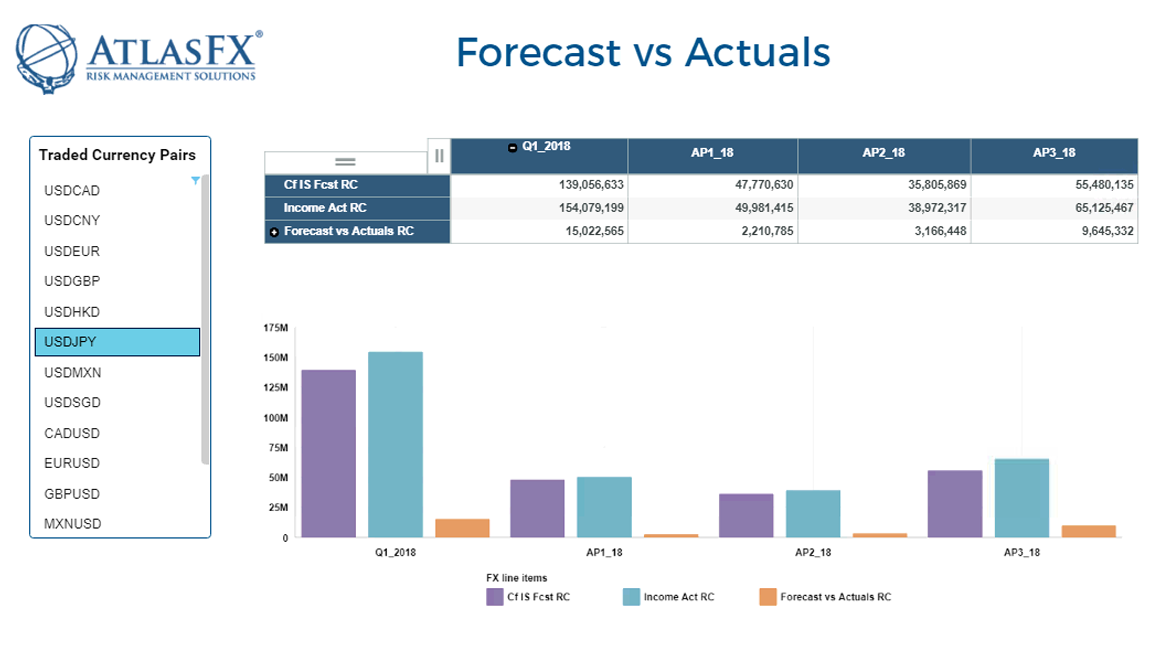

Forecasting KPI’s

The phrase “You get what you measure” certainly applies to forecast deviation. AtlasFX provides forecasting deviation dashboards and visualization that improve accountability.

Build methodology

Many companies struggle with forecasting their balance sheet exposure, often assuming their last “known exposure” is the “best estimate” for the next month-end exposure that will be remeasured. With AtlasFX, they can see the detail of which items flow to the balance sheet from the income statement, enabling them to utilize income statement forecasts as part of their balance sheet forecasts where appropriate. This tends to increase both accountability and accuracy, especially when combined with the best-practice processes around FX liquidity management. Different accounting environments (i.e. “daily rate” vs “month-end” accounting rates) influence the ideal forecasting process (in a daily rate environment, some forecasts may not be required at all), and AtlasFX has the flexibility to work with any situation.

For a deeper dive into the challenges of forecasting balance sheet FX exposure, please see our blog topic “The Pitfalls of Balance Sheet Forecasting and How to Avoid Them”.

Seasonality trends

With AtlasFX, foreign exchange risk managers do not just see their most recent data, they get detailed analysis on their historical information as well. AtlasFX allows the optionof manual or system calculated forecasting at any level of the forecast. Whether it’s helping a forecaster by showing the actual data from the same period the prior year, or suggesting a line-specific forecast based on a growth rate applied to the calculated seasonality, AtlasFX can help “see where the puck is going” and anticipate the FX exposures before it’s too late to hedge them. Identifying past large “one-off” items that are often related to quarter end or year-end tax activity can also help the FX risk manager from repeating prior mistakes.

Forecasting KPI's

When it comes to forecasting the FX exposure on the balance sheet, companies at-large have an accountability problem. This is not part of the typical FP&A monthly forecasting cadence that gets a lot of attention throughout the company. While there is ownership throughout many categories of the income statement, this is not the case for the balance sheet. The unfortunate results of this are two-fold. Those tasked with forecasting the balance sheet are often:

- Ill-equipped to do this task well.

- Do not have accountability when their forecasts are poor.

AtlasFX provides detailed forecast deviation reports, including easy to understand visualization and dashboards to help engage an extended team in solving the important problem of managing FX risk.