Optimize all aspects of your FX trading with AtlasFX

Hedging your FX exposures can be challenging, as there are many opportunities for executing in an inefficient way. With AtlasFX, your Treasury team can eliminate any unnecessary trading expense and spot variance.

Optimizing FX trading is crucial

There are several areas where FX trading inefficiencies can arise, but Treasury team scan avoid them by utilizing the process optimization and flexible technology that is embedded in the AtlasFX solution. By utilizing AtlasFX, Treasury teams can:

- Manage liquidity trades efficiently.

- Reduce external trades through appropriate netting and/or triangulation.

- Optimize forward point expense against their portfolio volatility.

FX trading optimization

Manage liquidity

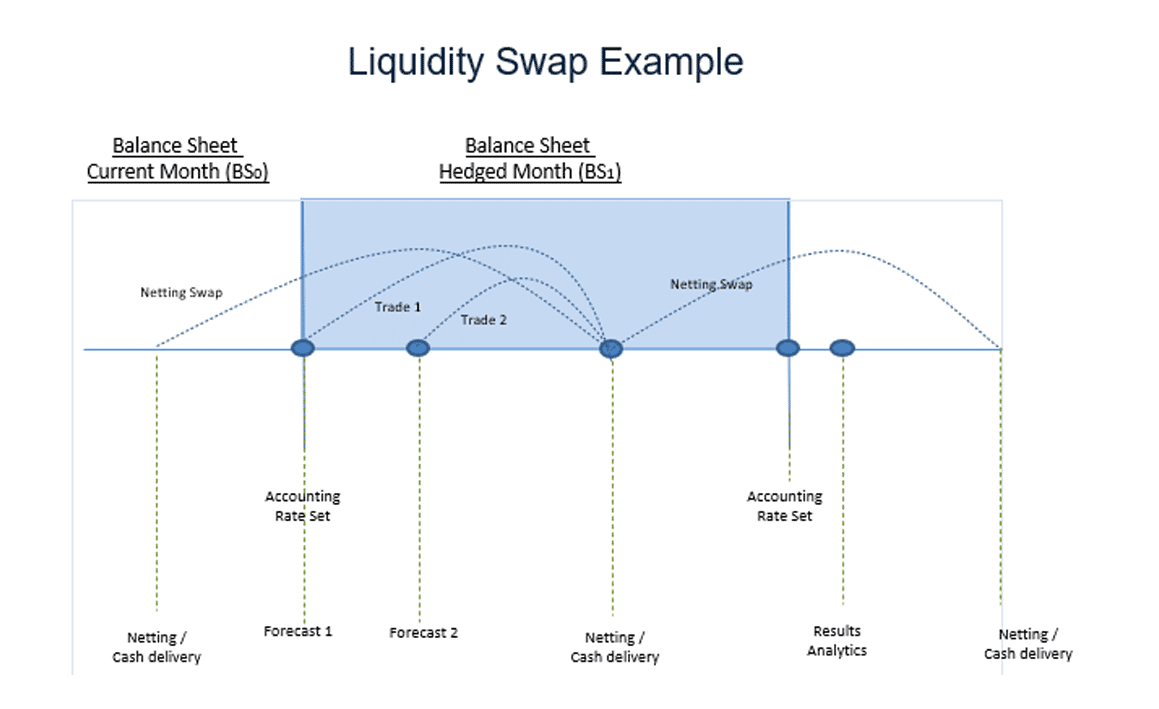

Eliminate unnecessary spot trading that is better managed with FX swaps, as spot liquidity needs are offset by the adjustment in balance sheet hedges.

Netting & triangulation

Reduce external trading through netting of exposures to any desired level, including triangulating cross-currency pairs to the equivalent USD paired trades.

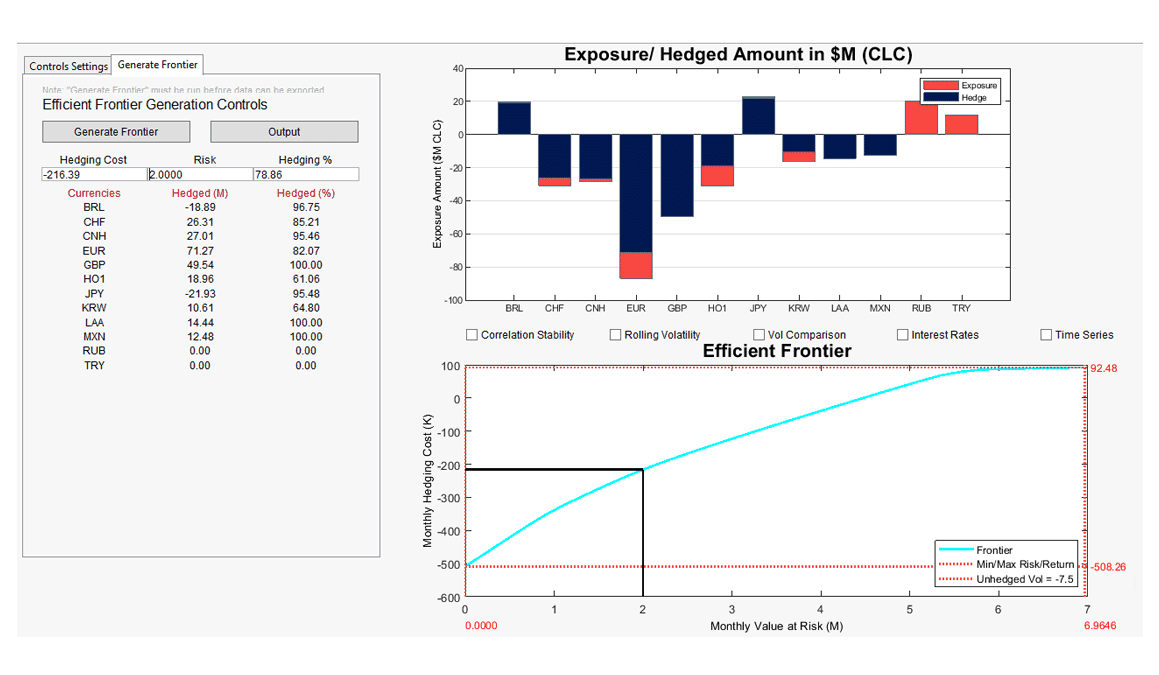

Efficient frontier

Optimize forward point cost (or benefit) with the risk reduction at the portfolio level (measured by VaR), with our FX Optimizer.

Managing liquidity

When it comes to managing intra-month FX volatility, many FX risk managers struggle to do this effectively, as there are several ways where problems can arise. For companies that do not deliver on their FX trades, they may be closing them out (gain/loss settling) at rates inconsistent with the rates they are trying to protect against. They may also have an inefficient “hand-off” between separate cash flow and balance sheet hedging programs. Lastly, there may be a “netting day” or multiple days within the month where excess local currency is converted to USD or is bought for funding requirement.

These liquidity trades may be inappropriately executed as spot trades where swap trades (the far leg being the balance sheet hedge adjustment) would be more ideal. Please read “Mistake #6: Creating Unnecessary Volatility From Liquidity Management” – white paper for more detail.

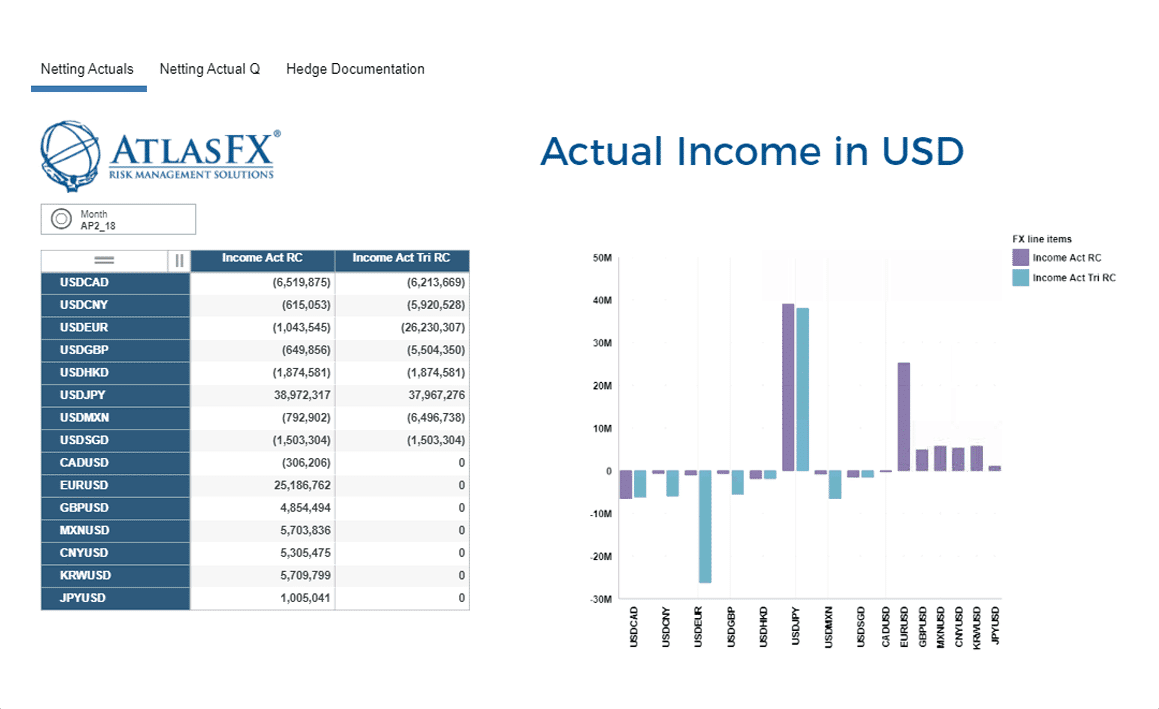

Netting & triangulation

With all the possible combinations of exposures an FX risk manager may face, reducing these combinations to a manageable list can be a challenge. They need to net their long and short positions for each currency pair, but also may need to combine exposures where the transaction currency (TC) and functional currency (FC) are opposite for different entities. Further more, they may have several cross-currency exposures where neither the TC nor the FC are USD. With AtlasFX, they can net and/or triangulate these exposures to the fewest and most liquid currency pairs for external trading, while keeping all the detail needed for internal trades and allocation purposes.

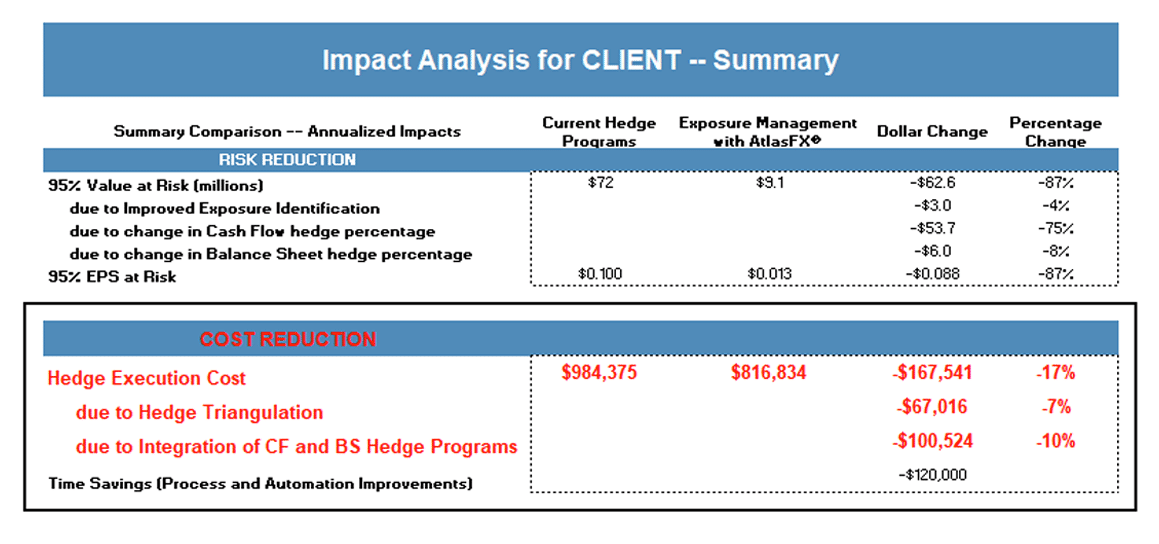

Efficient frontier

Companies that have long exposures in emerging market currencies are very familiar with the potentially high costs of forward points when trying to hedge these exposures. Some choose to leave certain exposures unhedged for this reason but may not be making efficient decisions from a portfolio perspective. With Atlas’ FX Optimizer tool, FX risk managers can see all the points along the efficient frontier for their entire FX risk portfolio (which can also include commodities if applicable). This mean-variance optimization solves for the highest expected return (analyzing forward points) for a given level of portfolio risk, measured by VaR.