Risk management for foreign currency transactions and the translation of foreign currency necessarily begins with an understanding of the accounting rules that determine the representation, re-measurement, and translation of foreign currency amounts and their impacts on financial statements, earnings, and equity. SFAS 52, Foreign Currency Translation, which was issued in 1981, defines and sets the rules for dealing with topics including:

- Reporting enterprise;

- Reporting currency;

- Functional currency;

- Foreign entity;

- Local currency;

- Foreign currency transactions;

- Re-measurement; and

- Translation.

And before we proceed, let us point out that SFAS 52 and SFAS 133, Accounting for Derivative Instruments and Hedging Activities, (U.S. GAAP Codification ASC #830 and #815, respectively) contain a wealth of information that cannot be covered in this overview. They are available at www.fasb.org.

We would also point out that we are neither professional accountants nor offer accounting advisory services. The purpose of this paper is to develop an understanding of the accounting literature and accounting practices from the perspective of risk management practitioners to better understand the formation of currency risk at an international corporation.

RISK ACCOUNTING FRAMEWORK

First, some definitions. The Reporting Enterprise is a combined entity, typically a public corporation, while Foreign Entities are operations including subsidiaries, branches, and divisions which are solely or jointly owned by the reporting entity. The reporting enterprise reports financial performance, financial position, and cash flows in the Reporting Currency: U.S. dollars for U.S. public companies. Foreign entities utilize a Functional Currency, reflecting their particular economic environment and activity, which is often different from the reporting currency. Industry surveys show that 20% to 30% of firms have primarily USD-functional currency subsidiaries, while the remainder have primarily local-currency functional subsidiaries.

There are two principal types of FX risk:

Transaction risk arises from current balances, typically accounts receivable and payable that are denominated in a currency other than the functional currency of that entity. As an example, a GBP-functional entity could hold a contract to receive payment for goods or services with the price denominated in euros. These euro receivables would constitute a transaction risk for this GBP entity. FAS 52 specifies that these non-functional currency balances will initially be recorded at the exchange rate in effect on that date to be measured in the functional currency of that entity. At each balance sheet date, these recorded balances will be adjusted to reflect the current exchange rate as of the balance sheet date. The adjustment to reflect current exchange rates for non-functional currency balances is referred to as remeasurement.

Transaction risks impact current earnings as non-functional currency balances alter the value of expected cash flows when evaluated in an entity’s functional currency. Forecast non-functional currency revenues and expenses impact future earnings.

Translation risk occurs when the financial statements of entities that do not use the reporting currency as their functional currency translate functional currency balance sheet and income statements into the reporting currency of the consolidated firm. For example, GBP-, EUR- and JPY-functional subsidiaries of a USD-reporting currency firm would translate their individual financial statements into the reporting currency for each balance sheet date. USD-functional currency subsidiaries of firms that use the USD as their reporting currency would not require currency translation, while the parent of local-currency subsidiaries would encounter translation risk on both the balance sheet and income statement.

Changes due to balance sheet translation are reflected in the Cumulative Translation Account, an equity category. Income statement translation will impact net earnings of the consolidated entity, but will not typically impact cashflow.

ACCOUNTING REPRESENTATION

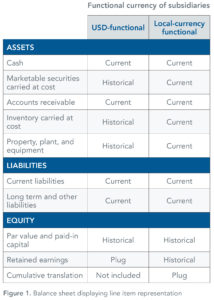

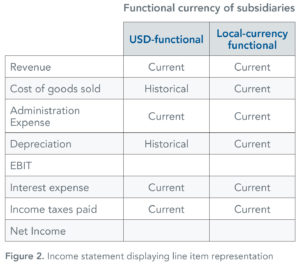

Examining the currency rates used for balance sheet and income statement items can provide a more thorough understanding of how currency changes can impact a firm. We mentioned earlier that the functional currencies of subsidiaries may match the reporting currency of the consolidated entity, or they may not. We refer to the latter case as local-currency functional entities, while subsidiaries of USD-reporting firms that also utilize the U.S. dollar are most often referred to as USD-functional entities. The accounting rate for specific line items on the balance sheet and income statement will vary depending on whether the subsidiary uses the reporting currency, or a local currency, as we will explore in Figures 1 and 2. For both Figures, “Current” denotes a current exchange rate, while “Historical” denotes an historical rate. We will assume that the reporting currency is U.S. dollars throughout this paper.

Balance Sheet – Transaction Risk

Currency transaction risk can impact a firm and its subsidiaries whether the subsidiaries are USD-functional or local-currency functional. As exchange rates change from balance sheet date to balance sheet date, non-functional currency items that are represented at current exchange rates will change in value when viewed in the context of the entity’s functional currency. This is the essence of transactional currency exposure, and it goes beyond the balance sheets of subsidiary entities as the remeasurement of non-functional currency items on the balance sheet of the parent are also a source of currency transaction risk.

Figure 1 depicts an additional difference between USD-functional entities and local-currency functional entities. As all of the assets of local-currency functional entities are represented at current exchange rates, the calculation of offsetting exposures is a straight forward exercise. While for USD-functional entities, the historical exchange rates used for several line items (summarized in Figure 1, but detailed in FAS 52) means that a differentiation between asset categories must be made when an exposure offset between assets and liabilities is evaluated.

– Translation Risk

A firm that uses the U.S. dollar as the reporting currency, as well as the functional currency for all foreign subsidiaries, will not be impacted by currency changes due to translation. As the balance sheets of all entities utilize the U.S. dollar, no translation from other currencies is required. The balancing item for this balance sheet will be retained earnings, as it is for a domestic U.S. firm with no foreign subsidiaries.

Local-currency functional subsidiaries represent all assets and liabilities at the current exchange rate on the balance sheet. With the typical equity items represented at historic exchange rates, a new line item reflecting currency translation, the Currency Translation Account (CTA), is introduced as part of the equity account. The CTA has the effect of “balancing” the balance sheet, which is necessary due to the difference between the representation of asset and liability accounts (at current rates) and non-CTA equity accounts (at historical rates).

Income Statement – Transaction Risk

Transactional currency risk refers to the re-measurement of items on the balance sheet (described in the previous section).

– Translation Risk

As with balance sheet translation, subsidiaries whose functional currency matches the reporting currency of the combined firm do not entail translation risk.

The income statement translation for local-currency functional subsidiaries will create earnings risk due to currency for the combined firm. FAS 133 does not recognize reported earnings as a currency risk category that is available for special hedge accounting, but the different rate setting methodologies of income statement items for USD-functional firms allow hedges that decrease earnings translation risk to qualify for hedge accounting in some situations.

BOOKING TRANSACTIONS

We have described the processes for remeasurement and translation at the end of a fiscal period, but the booking of items during a fiscal period also merits attention. FAS 52 states “for revenues, expenses, gains, and losses, the exchange rate at the dates on which elements are recognized shall be used.” Although the same paragraph allows that “an appropriately weighted average exchange rate for the period” can be used due to the impracticality of using multiple exchange rates for multiple elements across time. Later in the Standard, it states that “the use of other time- and effort-saving methods to approximate the results of detailed calculations is permitted.” As with other accounting rules, consistency of approach across time is a key requirement.

Our consulting work confirms that firms follow all three possible methodologies, but the proportions are not equal. We have encountered a few firms with very small amounts of FX risk that record each non-functional currency income and expense item at the current exchange rate, following the first FAS 52 method. However, firms with larger amounts of FX-impacted income and expense items generally use either an average rate for the current period or the previous period’s ending exchange rate, and they follow these methodologies in roughly equal proportions.

The choice between period ending rates and period average rates for the booking of balance sheet items is a significant one. The areas affected by this decision include the trade off between transactional and translation exposures and the timing and magnitude of each, the appropriate methodology and financial products for the hedging of these exposures, and the relative impacts on earnings and equity due to these exposures and their hedges. Also obvious from this list is that risk management and related systems and processes are also impacted.

We have seen firms where the chosen booking rate methodology enhances the risk management process, as well as firms where the methodology increases the work load with little payoff. Obviously, the important point is that accounting and other process decisions should enhance risk management for the particular firm, and we created our AtlasFX technology solution to offer flexibility in being able to work with a range of choices related to risk management. In the near future, we will publish a number of additional papers on these topics.

CONCLUDING REMARKS

Understanding the precise accounting representations and processes that produce currency exposures within a corporation can be a valuable step towards measuring and managing these exposures. While we are not accountants, we have attempted to describe the rules and practices for recording entries and updating the balance sheets and income statements of local-currency and USD-functional subsidiaries, as well as for parent and consolidated entities. A firm’s own auditors are, of course, the final arbiters of appropriate accounting practices for a firm, but we hope that a better understanding of the relevant accounting statements and practices across firms will provide treasury professionals with some of the knowledge required to best manage a firm’s risk.

About the Author

John Bird is a Partner with Atlas Risk Advisory, where he advises corporate treasury groups on risk management practices and processes and helps implement AtlasFX, the most comprehensive FX risk management software solution available. John has more than 30 years of experience in risk and portfolio management, quantitative modeling, research and trading. For 14 years, he led the Portfolio and Risk Strategy group at Bank of America/BofA Merrill Lynch, the top-rated bank group providing client risk advisory and research. John consulted with more than 1,000 corporations, asset managers, and other entities on risk and portfolio issues, and he built a set of systematic FX models that he ran with bank and client capital. In previous positions, he managed fixed income and FX derivatives trading groups for CIBC/Wood Gundy and First Interstate Bank and worked in research and consulting positions. John holds a BA in Management Science from UCSD and an MBA in Finance from USC, and he has spoken and published on many aspects of risk and portfolio management.

Disclaimer

The information contained in this publication is provided for information purposes only. The information contained herein has been obtained or derived from public sources believed to be reliable, but we do not represent that it is accurate or complete and should not be relied upon as such. Any opinions or predictions constitute our judgment as of the date of this publication and are subject to change without notice.

All rights reserved. Please cite source when quoting.