Industry surveys show that the majority of firms with currency risk practice some level of exposure management. There is also a growing list of academic work documenting the benefits of hedging (we list some illustrative surveys and studies below). Despite this evidence, there remain some firms that do not manage their currency risk. We created a list of the top five excuses that we’ve encountered for not hedging, and will address the logic of each.

- The gains and losses will average out across time;

- Our competitors don’t hedge;

- We report results on a constant currency basis;

- We can’t access our ERP data;

- Our forecasts are poor; and

- We can’t relate hedge results to actual results.

THE GAINS AND LOSSES WILL AVERAGE OUT

An often-heard reason for avoiding the management of market risks is that unhedged gains and losses will average out over time. Let’s test this thesis by exploring three different questions, with increasing levels of relevance.

Will the gains and losses on a single currency exposure that is constant average out at some point in time? The logical answer to this question is yes. But this question appears to be too narrow to support the non-hedge argument. First, how many exposures are constant across time, and second,will the time period that the gains and losses average out match the timing of the firm’s financial results? Viewing a chart of values for a single currency will often show that the currency will retrace some of the same levels, especially levels towards the middle of the chart. However, what is the likelihood that EUR/USD, for example, has quarter ending levels that are the same for consecutive quarters? Or that these levels are the same across many quarters or years?

Will the gains and losses on a single currency exposure that varies average out? Again, the answer is yes, but this result is also of little use. Let’s say that an exposure of long JPY against the dollar increases by 10% in a year. Mathematically, unless the initial currency level were at an extreme, there may well exist a point in time where the initial exposure amount times the initial currency level is equal to the increased exposure amount multiplied by a lower currency level. However, we again question the value of this justification as the time period where our equivalence occurs is very unlikely to coincide with the financial calendar of a firm.

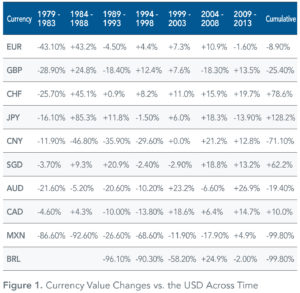

Will the gains and losses for a portfolio of currencies average out for a portfolio of changing exposures? We believe that this question is the correct one for accurately addressing the likelihood of a firm’s impacts due to currency changes averaging out over time. A firm’s exposure profile tends to be a complex portfolio of long and short positions of various amounts spread across a number of currencies. And these portfolios tend to vary across time, with some exposures growing or shrinking more quickly than others. With that in mind, Figure 1 displays five year groupings for a set of currencies that constitute exposures for many firms, beginning with 1979, the retirement year for the European currency “snake” and the adoption of freely floating exchange rates.

For a firm to be immune to currency, all of the long and shorts in a firm’s exposure portfolio would have to change in value such that the sum of impacts would be zero for a given time period. Examining the currency changes in Figure 1, and noting the variation in the magnitude of changes within and across the time periods, the probability of currency changes producing a zero impact on the exposure portfolio of a specific firm seems remote. And to support the idea of not hedging, we would want the impact of currency changes to be zero for consecutive periods, with those periods matching the financial calendar of the firm. It seems unlikely that the combination of currency and exposure changes would produce a net zero impact for any time period, and the added requirement of matching a firm’s financial calendar would seem to decrease the likelihood of this perfect synchronization to that of a lottery win.

OUR COMPETITORS DON’T HEDGE

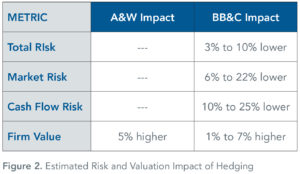

An often-quoted academic study is by All ayann is and Weston (2001). They found a market valuation premium of 4.87% for market-risk-hedging firms across 720 large non-financial U.S. firms. A study focusing solely on the corporate management of currency risk was published by Bartram, Brown, and Conrad (2009). They studied the market impact of FX hedging by large non-financial firms across 47 countries. They compared FX hedging firms with non-hedging firms in terms of market valuation and several aspects of risk. The results for both studies are summarized in Figure 2.

With research establishing a valuation premium and a risk reduction for firms that hedge, not choosing to hedge currency risk because of the non-hedging of a competing firm may not make the firm worse off relative to that competitor, but would be expected to make the firm worse off in relation to the broader universe of firms.

WE REPORT RESULTS ON A CONSTANT CURRENCY BASIS

Many firms report financial results on a constant currency basis in addition to the actual results required by public accounting rules. The thought is that the constant currency results will allow investors to evaluate sales and other trends without the impact of currency. This practice seems like a valuable exercise. But in a discussion with a large firm that has reported constant currency results for a number of years, we asked a senior treasury professional about the impact of quoting constant currency results? We were told that no investor or investment firm had ever asked a single question about the constant currency results. Our interpretation of this statement is that actual financial results matter to investors, not the constant currency results. While the constant currency numbers may add to the disclosure of corporate performance, we would argue that this practice is not a substitute for the management of a firm’s risks.

WE CAN’T ACCESS OUR ERP DATA

Important information for determining both balance sheet forecasts and income statement/cash flow exposure forecasts resides within a firm’s ERP system(s). Transactional exposures arise when the currency of payment or receipt is different from the unit’s functional currency, with the remeasurement of these balances impacting current income and expense. This information is stored within the ERP system(s), and can be aggregated by currency to determine hedgeable exposure amounts. In addition, past ERP data can assist with the creation and refinement of income statement/cash flow exposure forecasts.

Accessing this information can be problematic. IT resources with access to this information are generally fully employed with other work, so that projects initiated by treasury often have large price tags and long time lines. Another alternative for accessing this information is for treasury to use the available management information system. But we generally see MIS packages not providing the information required by treasury unless these systems were specifically created for that purpose. A final solution for information access is to utilize a system created to link with ERP system(s) and provide exposure forecasts. Atlas partners have created and refined a system providing these capabilities over the last 20 years, and believe that our current offering provides valuable exposure information linked with risk management analytics while requiring a low level of IT commitment at a reasonable cost.

OUR FORECASTS ARE POOR

We have assisted with the creation and refinement of hedging programs for a very large number of firms. We can report that forecasting exposures at the outset of a risk management program tends to be a difficult exercise, for firms varying in size from very small to the world’s largest. We can also report that the forecasting process can and generally does improve over time. There are systems and processes, including those offered by Atlas, which can improve the process. And we believe that mastering the forecasting process is primarily a resource allocation and process issue. If the impact of variable financial results due to currency is significant, then a system and process can be developed that can improve exposure forecasting, and ultimately reduce the impact of currency changes across time. The cost/benefit evaluation of the problem and proposed change is a valuable exercise, and one that we have assisted with many times.

WE CAN’T RELATE HEDGE RESULTS TO ACTUAL RESULTS

Similar to our comment on forecasting, we view the comparison and explanation of actual and hedge results as an important part of a comprehensive risk management process. The calculations of hedge results and actual results should be a normal part of the monthly or quarterly closing process for establishing financial results. The following step of comparing and explaining the two numbers along with the interrogation of discrepancies is an extremely important step that should determine the effectiveness of hedging for the particular period. In addition, this comparison of actual results to hedge results across time should be a valuable component of the overall evaluation of a firm’s risk management processes. We work with many firms that routinely evaluate the efficacy of their risk management processes, with the monthly results comparison constituting a valuable piece of information in this review.

CLOSING COMMENTS

We hope that our thoughts are helpful. We most often find that treasury professionals understand market risks and the value of managing those risks. But these professionals occasionally need help in explaining the likely benefits to management and non-treasury colleagues. It is for those individuals that we have attempted to describe some of the problems and best answers in relation to the management of currency risk.

REFERENCES

- Allayannis, G. and J. Weston, “The Use of Foreign Currency Derivatives and Firm Market Value”, Review of Financial Studies, 2001.

- Bartram, S., G. Brown, and J. Conrad, “The Effects of Derivatives on Firm Risk and Value”, working paper, 2009.

- International Swap and Derivatives Association, Inc., “Derivatives Usage Survey”, April 2009.

About the Authors

John Bird

John is a Partner with Atlas Risk Advisory, where he advises corporate treasury groups on risk management practices and processes and helps implement AtlasFX, the most comprehensive FX risk management software solution available. John has more than 30 years of experience in risk and portfolio management, quantitative modeling, research and trading. For 14 years, he led the Portfolio and Risk Strategy group at Bank of America/BofA Merrill Lynch, the top-rated bank group providing client risk advisory and research. John holds a BA in Management Science from UCSD and an MBA in Finance from USC, and he has spoken and published on many aspects of risk and portfolio management.

Gavin O’Donoghue

Gavin is a Founding Partner of Atlas Risk Advisory, where he leads the development and implementation of the AtlasFX technology. He has more than 15 years of treasury risk management experience, holding senior positions with large blue chip companies. Gavin was Global Treasury Lead with Pfizer’s Global Financial Solutions Group and prior to that was responsible for running Hewlett Packard’s $5 billion balance sheet programme. He has experience in treasury systems, liquidity management, and lease financing. Gavin holds a B.A. in Economics and Computer Science, and a post-graduate diploma in Applied Economics from University College Cork. He also holds a BSc. in Financial Information Systems from Trinity College Dublin.

Disclaimer

The information contained in this publication is provided for information purposes only. The information contained herein has been obtained or derived from public sources believed to be reliable, but we do not represent that it is accurate or complete and should not be relied upon as such. Any opinions or predictions constitute our judgment as of the date of this publication and are subject to change without notice.

All rights reserved. Please cite source when quoting.