Today’s finance professionals are typically well equipped to handle many complex financial problems. They are often experts with Excel and other finance tools, both inside their IT environment and in the cloud, and they are adept at creating various models that are helpful in understanding their business. Despite their extensive expertise, however, many finance professionals have a hard time wrapping their minds around issues related to foreign exchange (FX) risk.

This is largely due to the fact that FX issues are rarely the top concern of finance professionals who do not work in Treasury. Even for those who do work in Treasury, those tasked with managing FX risk are often learning on the job. They need to interact with and rely upon folks outside of Treasury who have other pressing concerns. When it comes to FX, many people are intimidated by “the markets” and fear they might make the wrong decision that will lead to a loss. Even folks who are comfortable making quick decisions elsewhere find themselves “passing the buck” or sticking with an out-of-date strategy when it comes to managing FX risk.

The result is that too many corporate FX hedging programs are reactive and not proactive. The poorly forecasted FX exposures differ significantly from the actual exposures, and there is little understanding of the interaction between income statement and balance sheet risks. The FX risk managers live in fear each month that the volatility in their hedging results will draw unwanted attention from senior management.

When the inevitable bad month happens, the FX team finds themselves under an unwanted microscope. They scramble to put together some ad hoc analysis to try and figure out what went wrong, and perhaps a tweak to the process is put in place in an attempt to keep that particular problem from happening again. Just like in the game “whack-a-mole”, a different problem will soon surface, leading to another inevitable bad month and unwanted attention…

BE REALISTIC ABOUT RESOURCES

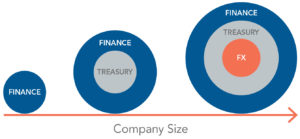

Given the complexity of the problem, it’s important to be realistic about your company’s ability to adequately manage FX risk on its own. For a start-up company, there is likely a modest-sized finance team with no dedicated treasury personnel. A mid-sized company may have a Treasurer and perhaps one or two other treasury members, but no one dedicated entirely to FX. Only large, well-established multinational companies will likely have the scale to support a dedicated FX team, where there can be a reasonable expectation of retaining an adequate level of continuous FX expertise.

What follows is a discussion of some guiding principles and traits that should be present in a “world-class” FX risk management team. This is realistically only accomplished in a large enough organization where continuous FX expertise can be maintained – smaller organizations should use a combination of theirlimited resources and appropriate outsourcing to establish as many of these best practices as possible.

DON’T LET THE ACCOUNTING TAIL WAG THE DOG

Like many finance topics, there are many accounting rules that are specific to FX. This paper will not go into the details of FAS 133/IAS 39 or FAS 52/IAS 21, which many FX professionals are familiar with, other than to make the following observation: Many FX related accounting rules are written with a fair amount of subjectivity and flexibility in their interpretation. This is important, as there isn’t a simple “FX blueprint” that every company follows. Differences in functional currency setups for foreign entities, accounting rate setting methodologies, entity structures and relationships, and intercompany activities, to name a few, all impact how various FX accounting rules should be applied to any given company.

Because of this, it is crucial for the FX professional to play a significant role in interpreting the FX accounting rules for their particular situation. It is often the case that a company’s auditors are more familiar or comfortable with what they may have seen at a different company, or perhaps a rookie auditor may not have much FX related experience at all. They may question something they are less familiar with or don’t understand. We’ve come across many Treasury organizations that avoid having FX related conversations with their auditors; therefore, they don’t push forward with an idea or solution that could be optimal for their company. World-class FX organizations don’t let the “accounting tail wag the dog” when it comes to FX risk management. When they find an optimal solution to an FX related problem, it is typically the case that a valid interpretation of the FX accounting rules can support such a solution.

PARTNERING WITH BUSINESS

As mentioned above, there are many different structures and methodologies used amongst different companies, which influence their sources of FX risk. Particularly in the case of cash flow hedging exposures, there is no “one size fits all” solution available that can be described in this paper. Third-party foreign currency transactions may be the basis for cash flow hedging in a company with USD functional subsidiaries, while USD based intercompany transactions may be the hedged item in a company with local currency functional subsidiaries. Many companies have mixed environments, consolidate exposures in rebilling centers or in-house banks, or may even have multiple businesses with completely different risk profiles.

It is crucial that the FX professional have a solid understanding of what is driving the FX exposure in their company. There are no shortcuts here – they need to understand their companies forecasting models and cycles, intercompany arrangements, accruals, and the timing of significant tax bookings where foreign currencies are involved.

While digging into these issues, the FX team may discover that the businesses have attempted to avoid currency volatility as much as possible, and in doing so, increased their cost of doing business in other ways. Transacting only in USD worldwide typically results in getting worse pricing (lower revenues and/or higher expenses) than the company otherwise would have if it transacted in the local currencies around the globe. If there is a foreign customer or supplier that represents a significant percentage of the company’s business, a currency sharing clause can be a viable solution.

Treasury personnel also need to understand how FX is handled within the sales force. Do international sales personnel have USD based quotas or local currency based quotas? If they are selling in local currency, but have USD based quotas, what rate is being used to convert to USD? Having the wrong metrics in place for your sales force can be a critical mistake – for those selling in foreign currency, having a USD-based quota converted at an off-market annual budget rate can lead to a target that’s either too difficult or too easy to meet.

Too often, companies take the approach of setting “budget rates” or “planning rates” that may minimize administrative burden (i.e. set them once a year), but may also do a poor job of dealing with the reality ofvolatile markets. Ideally, the company utilizes planning rates that are at least somewhat aligned with their cash flow hedging timing (and therefore may change throughout the year).

Only the FX professional who understands the major drivers and cycles of their business can have a meaningful discussion on how to best hedge cash flow risks. How long to hedge and what percentage of the forecast to hedge are complicated questions, and the answers may change over time as business models change. Some forecasts may be consistently optimistic or off on their timing, while others might be overly conservative, and it’s important for the FX professional to understand any persistent skew that may exist in the forecasts.

One of the best ways to test if a particular cash flow hedging strategy makes sense is to stress test potential rate movements and walk through some “what if” scenarios with the business partners. What pricing changes, if any, can be made in response to currency moves? What will the competition likely do, which may differ depending on where they are based? What happened in late 2008, for example, the last time the dollar had extreme short-term appreciation? If they don’t think they can live with the modeled “post hedge” outcomes if there are significant currency shocks (at least 10% in either direction in a short time frame), then the hedge strategy may need adjusting.

When evaluating any cash flow hedging program, looking at the FX gains/losses by themselves obviously makes no sense. This often leads to the dysfunctional behavior of trying to predict future currency movements (usually based on 20/20 hindsight), or starting and stopping hedging at the worst times. It’s therefore critical to make sure that everyone is evaluating the success of a hedging program by looking at not just the FX results in isolation, but in combination with the offsetting movement of the cash flow exposures as well. Since they will never perfectly offset, the ability to quickly drill down further and explain the remaining deltas is also important. These include rate variations (gains/losses resulting from hedging at a rate different than the planning rate) and volume variations (forecast deviation and/or deviation due to a policy of hedging less than 100% of forecast, if applicable).

CASH FLOW AND BALANCE SHEET INTERACTION

As challenging as it may be to get the necessary cooperation of your business partners in creating an intelligent cash flow hedging program, it’s typically even tougher when it comes to balance sheet hedging. While cash flow hedging results are often passed onto the businesses, this is typically not the case with balance sheet hedging. There is also little accountability throughout a company for the line items on the balance sheet, especially at the level of detail that may be needed for FX hedging. As a result, getting an accurate and useful balance sheet forecast can be very difficult.

It’s also common for a balance sheet hedging program to run parallel with a cash flow hedging program, without a well thought out coordination between the two. Balance sheet forecasts are often derived by trending past balance sheet actuals, or even worse, assuming the current balance sheet snapshot is anadequate proxy for the end-of-month balance sheet exposure. Since there is so much company wide effort given towards forecasting cash flow exposures (revenues, expenses, etc.) that drive the balance sheet changes during the month, it is foolish to ignore this data when creating a forward looking balance sheet forecast.

While the detailed steps of an ideal balance sheet forecast are too much to cover here (a topic for another paper), there are some best practices to keep in mind when forecasting and hedging your balance sheet. First, try to avoid unnecessary spot trades throughout the month when dealing with liquidity issues (converting excess local currency to USD or vice versa). When a non-functional currency receivable is collected and becomes local currency cash, for example, there isn’t any change to the net monetary asset exposure. Converting this to USD will change the exposure, (as would converting USD to LC to pay a local currency payable), but executing a spot trade only for these liquidity purposes will cause FX gain/loss noise when done at a rate different that the accounting rate.

An FX swap that has an offsetting far leg that serves as an adjustment to the balance sheet hedge is therefore the best way to deal with liquidity management without creating unwanted FX volatility. When a well thought out balance sheet hedging program separates liquidity management from the true drivers of balance sheet volatility, there is no need to have to forecast the timing of collections or payables (which is not an easy task).

An additional best practice in balance sheet hedging is having the ability to understand your hedging results in a timely manner, which is easier said than done. Spreadsheets that attempt to do this can quickly become unwieldy, as there is a significant amount of data to manipulate and link together. When the previously described “bad month” occurs, a world-class FX team won’t be scrambling to put together an ad hoc report in order to figure things out. They will already have an understanding of the drivers of the results early in the close process, and potentially some items well in advance of the monthly close. Analytics that need to be readily available include the impact of forward points, the impact of the spot rate differing from the accounting rate on the FX trades, forecast deviation, and booking errors. A “booking error” is a catch all for any entity’s remeasurement that is inconsistent with the change in accounting rates for that month, and it is most easily identified with FX risk management software designed specifically for this purpose, such as AtlasFX.

DON’T BE THE SUCKER AT THE POKER TABLE

With all the difficulty involved in determining your FX exposures and offsetting trades, it would be a shame to execute those hedges inefficiently. Just like you wouldn’t want to be the least skilled player at a poker table, you don’t want to enter into an FX trade with any less information than your counterparty. If you trade FX over the phone without live prices in front of you, you are most likely leaving a lot of money on the table. Banks make a high percentage of their FX trading profits off the low percentage of their clients with the least market knowledge. You don’t have to have an expensive Bloomberg terminal in front of youin order to see live prices, so no investment is needed to know where the market is. There are numerous websites that show streaming FX spot prices.

In addition to this basic trading requirement, there are other ways to reduce your trading costs. First, try to net exposures internally and use internal trades between different entities or hedging portfolios where possible. Second, always bid out external trades to multiple counterparties and ask for two-way prices. Third, trade off of fixing rates when possible – this is especially useful at the end of the month if you can set your accounting rates based on the same fixing rates that you use to execute your hedges, eliminating slippage. Fourth, closely monitor your counterparty risk and understand how to reduce it quickly if necessary. The biggest loss you can have on a trade is one where you deliver your side of the transaction and don’t receive the opposite payment!

CONCLUDING REMARKS

Even though creating a highly effective FX hedging program is a difficult task, the downside of not doing so can be enormous. It is not uncommon to hear a CEO or CFO blame currency volatility for a quarterly earnings miss, and investors have little patience for these types of surprises. As complex and fast-moving as today’s businesses have become, Treasury organizations need to quickly become efficient at managing the evolving risks. The FX practitioners who follow the above guiding principles, network with fellow practitioners, and utilize the best FX risk management tools available today have a great chance of meeting this challenge.

About the Author

Scott Bilter is a Partner with Atlas Risk Advisory. Scott has held a number of executive positions with Hewlett Packard, including VP of Corporate Finance and Foreign Exchange, and VP of Worldwide Financial Planning and Analysis. He holds a BA in quantitative Economics from Stanford University, an MBA in Finance from the Anderson School at UCLA, and the Chartered Financial Analyst designation.

Disclaimer

The information contained in this publication is provided for information purposes only. The information contained herein has been obtained or derived from public sources believed to be reliable, but we do not represent that it is accurate or complete and should not be relied upon as such. Any opinions or predictions constitute our judgment as of the date of this publication and are subject to change without notice.

All rights reserved. Please cite source when quoting.