There exists a large body of academic and practitioner work evaluating corporate market risk management. An early theory, proposed by Franco Modigliani and Merton Miller (1958, 1961, 1963), was that changes in capital structure and risk management by a corporation were irrelevant because investors could fine tune their individual portfolios. Modigliani and Miller made many assumptions regarding transaction costs, taxation, information symmetries, lending, and bankruptcy. I, working together with a colleague and a professor, published a lengthy study testing each of these assumptions for my previous employer – listed below. We found that the M-M assumptions do not hold in today’s capital markets, a result matched by other authors. Other studies have quantified the impact of risk management on firms across industries, geography, and time.

The following will summarize work by me and others in an attempt to answer three crucial questions:

- Do firms hedge currency risk?

- Which currency risks are hedged?

And most importantly,

- What are the costs and benefits of managing currency risk?

DO FIRMS HEDGE CURRENCY RISK?

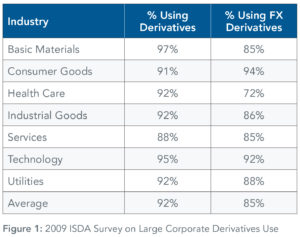

The International Swaps and Derivatives Association (ISDA) conducts user surveys on derivative use. The most recent survey, 2009, of the world’s 500 largest companies proclaimed “Over 94% of the world’s largest companies use derivatives to help manage their risks” in the survey news release. By excluding financial firms, the percentage of firms that use derivatives is 92%, but this is still a formidable number. Figure 1 lists overall derivative usage and Forex derivative usage by industry.

.

.

WHICH CURRENCY RISKS ARE HEDGED?

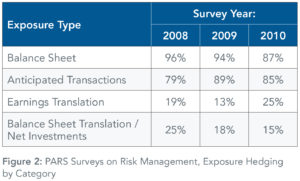

We’ll rely on the previous work of me and my associates for an answer to the second question. I led the Portfolio and Risk Strategy Group (PARS) at BofA and then BofA/ML, where we conducted annual surveys on risk management. Each survey polled about 200 U.S. firms, both public and private and across industries, on their risk management practices. Figure 2 displays the results of three recent surveys.

As the respondents to the PARS survey were bank clients, there is a bias towards firms that manage risk, but as the survey was conducted across interest rate, commodity, and forex clients, not all of the respondents hedged foreign exchange risk. Overall, the results are similar to the percentages of hedgers determined by the ISDA survey. Current and anticipated transactional exposures are hedged by a large percentage of firms, while translational exposures are hedged by far fewer firms. These results correspond with the hedge practices of a single firm discussed in the next section.

WHAT ARE THE COSTS AND BENEFITS OF MANAGING CURRENCY RISK?

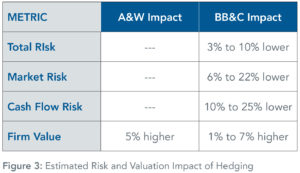

The first two papers that we will cite are by Allayannis and Weston (2001) and Bartram, Brown, and Conrad (2009). The Allayannis and Weston paper analyzed hedging practices and the market valuation impact across 720 large U.S. non-financial firms. They found a market valuation premium for firms that managed market risk – across interest rate, FX, and commodities – compared with firms that did not manage market risk. They found that firms that managed market risk had a market value premium of 4.87% compared to non-hedge firms.

Bartram, Brown, and Conrad studied the market impact of FX hedging by large non-financial firms across 47 countries. In addition to market valuation, they studied the impact on several aspects of risk. The results for both studies – double digit percentage declines across risk categories with single digit percentage increases in firm value – are summarized in Figure 3.

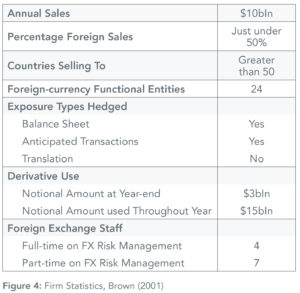

The final academic study that we will discuss is by G.W. Brown (2001). While other studies relied on market data for their analyses, Brown spent three months with a firm to analyze what risks they managed and why. Figure 4 lists aspects of the firm’s exposure profile and risk management operation.

This firm provides an excellent opportunity to study risk management costs and benefits. Before discussing numbers, we should report that the overall goals of the risk management program are to increase the certainty of operating margins and to reduce the negative impacts of currency changes.

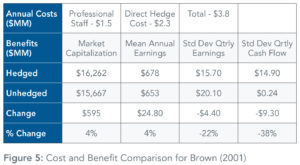

Estimating trading costs at ½ of the bid/offer spread, the firm has annual hedge costs of $2.3MM. Also on the cost side, professional staff and related costs are estimated at $1.5MM per year. On the benefit side of the equation, Brown worked with the firm to estimate the variability of key financial measures before and net of hedge results. On a quarterly basis, the standard deviation of earnings was reduced to $15.7MM from $20.1MM, a reduction of 22% while the standard deviation of cash flows was reduced to $14.9MMfrom $24.2MM, a reduction of 38%. It should be noted that these variability reductions are roughly comparable to those reported by Bartram, Brown, and Concord (2009).

The market value of the firm is not disclosed, but if we use the average P/E multiple for Industrial firms within the S&P 500 at the time of the study, we can create an estimate. Brown provides mean earnings on a hedged and unhedged basis, with mean hedged earnings $24.8 million higher for the hedged case. Applying the Industrial P/E multiple produces a market capitalization of $16.3 billion and $15.7 billion, hedged and unhedged respectively, an increase for hedging of $600 million or 4%. The costs and benefits of the FX hedge program from the Brown study are displayed in Figure 5.

For an annual cost of $3.8 million, mean earnings were increased, implying a higher market capitalization, with both earnings and cash flow volatility reduced. While the value of lower earnings and cash flow volatility might be difficult to explain, and market capitalization varies for a host of factors, the investment of less than $4 million annually to improve average earnings by nearly $25 million seems like an important data point, if only for a single firm, supporting the management of FX risk.

CONCLUDING THOUGHTS

We’ve reviewed a number of surveys and academic studies. The surveys display that a large percentage of firms hedge currency risk, and that transactional risk – both current and anticipated – are hedged by most of these firms while translational risks are hedged by a much smaller number of firms. The academic studies have documented both an increase in market valuation and a decrease in various risk measures associated with firms that hedge FX risk.

The most compelling support for corporate currency management may come from Brown (2001). While Brown only studied a single firm, his results are compelling and the size of the firm, exposure profile, and hedge practices are similar to a large numbers of firms. Whether a separate firm will realize the same ratio of benefits to costs demonstrated by Brown cannot be determined here. But the study, at a minimum, provides an excellent example of a risk management program as well as a framework for the evaluation of other risk management programs.

Overall, we believe that the combined evidence across our surveys and studies argues for currency hedging as the standard practice rather than the exception.

REFERENCES

- Allayannis, G., and J. Weston, “The Use of Foreign Currency Derivatives and Firm Market Value”, Review of Financial Studies, 2001.

- Bartram, S., G. Brown, and J. Conrad, “The Effects of Derivatives on Firm Risk and Value”, working paper, 2009.

- Bird, J. et al., PARS Corporate Risk Management Surveys #284, #303, and #320, Bank of America and BofA/Merrill Lynch, 2008, 2009, and 2010.

- Bird, J., R. Espinosa, and R. Harris, “Does Corporate Risk Management Add Value”, Bank of America Merrill Lynch Portfolio and Risk Strategy Monograph #311, April 2010.

- Brown, G.W., “Managing Foreign Exchange Risk with Derivatives”, Journal of Financial Economics 60, 401-448, 2001.

- International Swap and Derivatives Association, Inc., “Derivatives Usage Survey”, April 2009.

- Miller, M. and F. Modigliani, “Dividend Policy, Growth and the Valuation of Shares”, Journal of Business, 1961.

- Modigliani, F. and M. Miller, “The Cost of Capital, Corporate Finance and the Theory of Investment”, American Economic Review, 1958.

- Modigliani, F. and M. Miller, “Corporate Income Taxes and the Cost of Capital: A Correction”, American Economic Review, 1963.

About the Author

John Bird is a Partner with Atlas Risk Advisory, where he advises corporate treasury groups on risk management practices and processes and helps implement AtlasFX, the most comprehensive FX risk management software solution available. John has more than 30 years of experience in risk and portfolio management, quantitative modeling, research and trading. For 14 years, he led the Portfolio and Risk Strategy group at Bank of America/BofA Merrill Lynch, the top-rated bank group providing client risk advisory and research. John consulted with more than 1,000 corporations, asset managers, and other entities on risk and portfolio issues, and he built a set of systematic FX models that he ran with bank and client capital. In previous positions, he managed fixed income and FX derivatives trading groups for CIBC/Wood Gundy and First Interstate Bank and worked in research and consulting positions. John holds a BA in Management Science from UCSD and an MBA in Finance from USC, and he has spoken and published on many aspects of risk and portfolio management.

Disclaimer

The information contained in this publication is provided for information purposes only. The information contained herein has been obtained or derived from public sources believed to be reliable, but we do not represent that it is accurate or complete and should not be relied upon as such.Any opinions or predictions constitute our judgment as of the date of this publication and are subject to change without notice.

All rights reserved. Please cite source when quoting.