“There are two kinds of investors, be they large or small: Those who don’t know where the market is headed, and those who don’t know that they don’t know. Then again, there is a third type of investor: The investment professional, who indeed knows that he or she doesn’t know, but whose livelihood depends upon appearing to know”.

– William Bernstein

The above quote likely resonates with those who have followed any financial market for long enough, and the foreign exchange market is certainly not an exception. Nevertheless, those tasked with managing FX risk are often asked either where they think various FX rates are headed, or more commonly, to find out where “the pros” think they are headed. Far too often, someone in Corporate Treasury is asked to poll their relationship bankers in an attempt to determine the consensus FX rate forecasts, and then incorporate these directional views into the company’s hedging strategy. Surely these highly paid economic PhDs must know something more than the rest of us?

Pro’s v. Naïve FX Forecasting

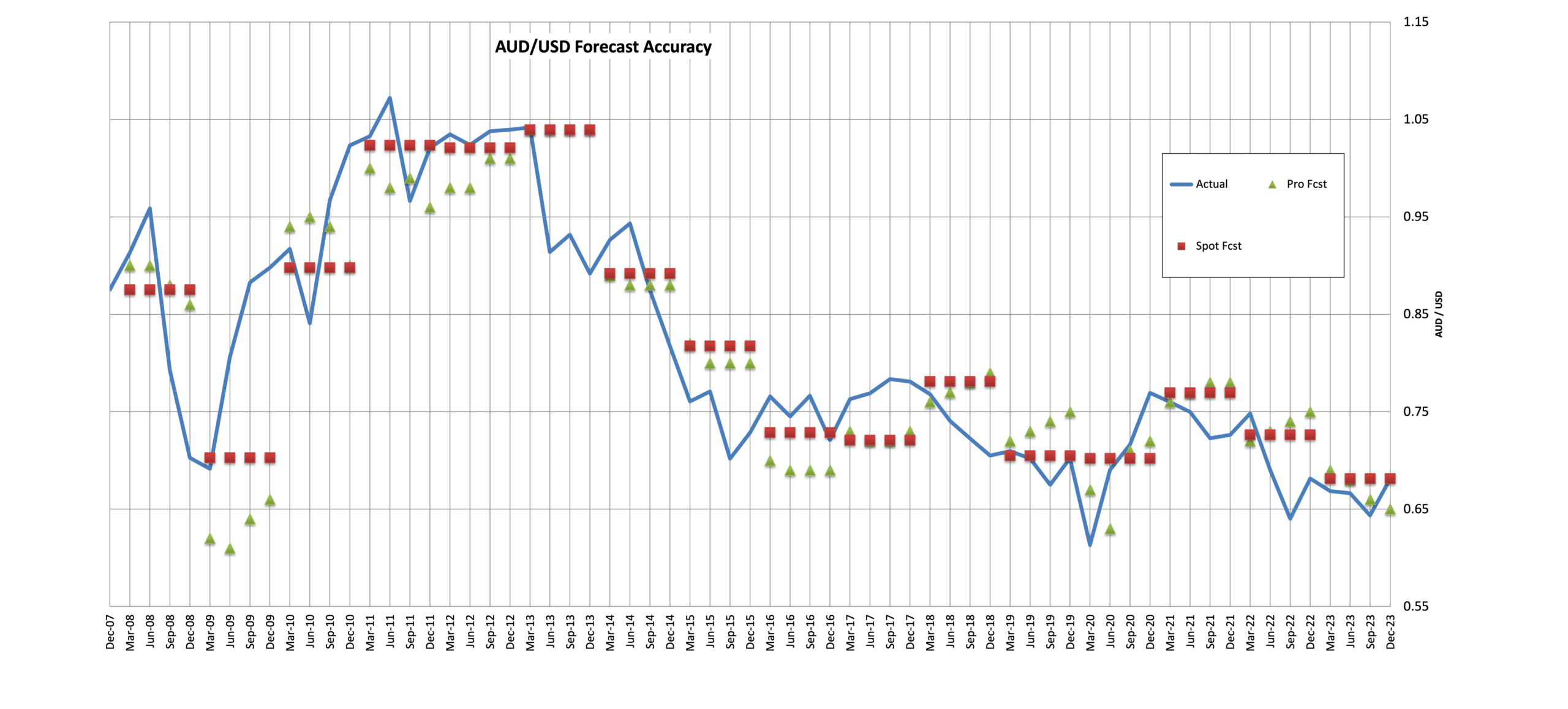

Analysis of consensus* FX forecasts as compared to a naïve method** of simply using the existing spot rate as the best estimate of future spot rate finds that the pros consistently do WORSE than the naïve forecasting method.

Why is this? As William Bernstein has pointed out, professionals aren’t necessarily getting paid to be accurate, and are often incented to make a bold prediction with the hope that it will come to pass. Nobody gives much credit to a boring but accurate forecast that may be similar to today’s environment, but a shocking prediction will probably generate more discussions or clicks, and potentially a future high-profile interview if it turns out to be accurate.

Worse yet, when a certain directional view becomes widely held by the forecasters (and therefore most likely to show up in a consensus forecast), this is often reflective of investments already being made in that direction, with little fuel left in the market to add to the trend. In absence of new money to help move in the forecasted direction, the markets often turn the other way, making these consensus forecasts contrarian indicators more often than accurate forecasts.

2023 – A Year in Review – Congratulations to Professional FX Forecasters for Edging out a Win

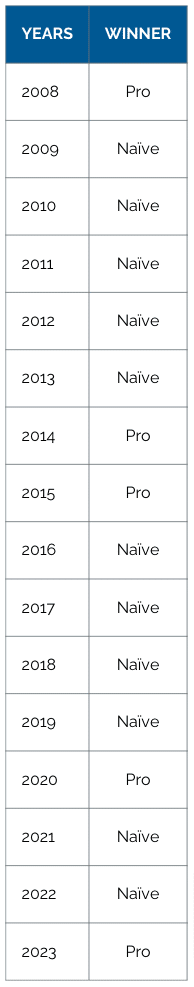

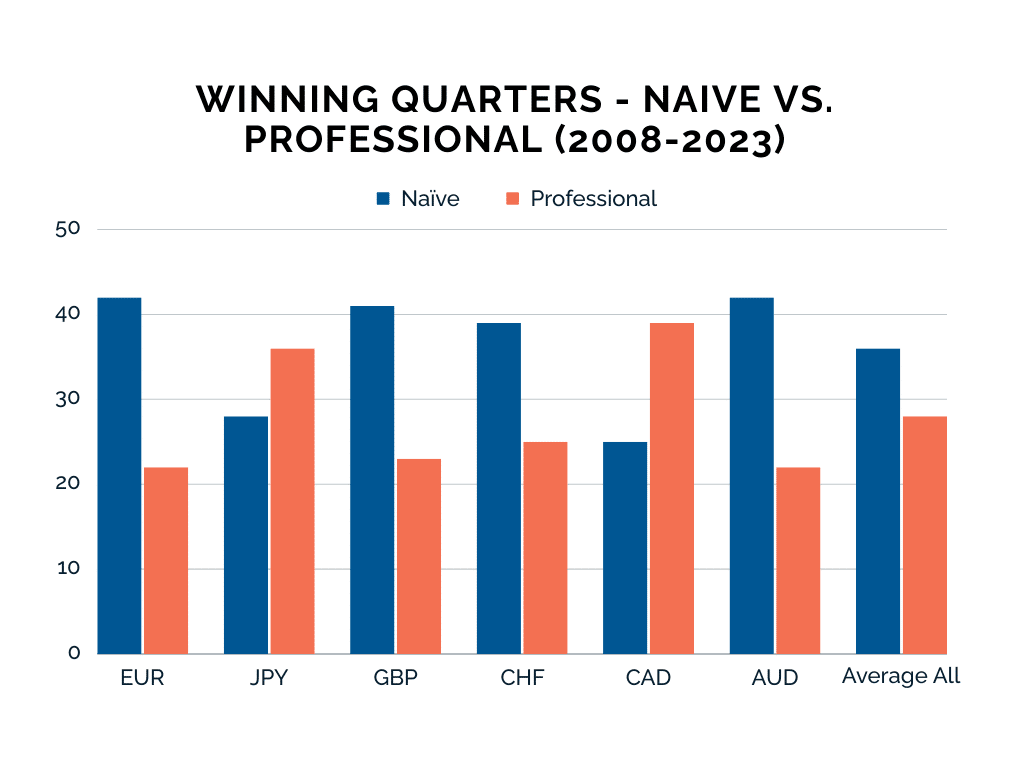

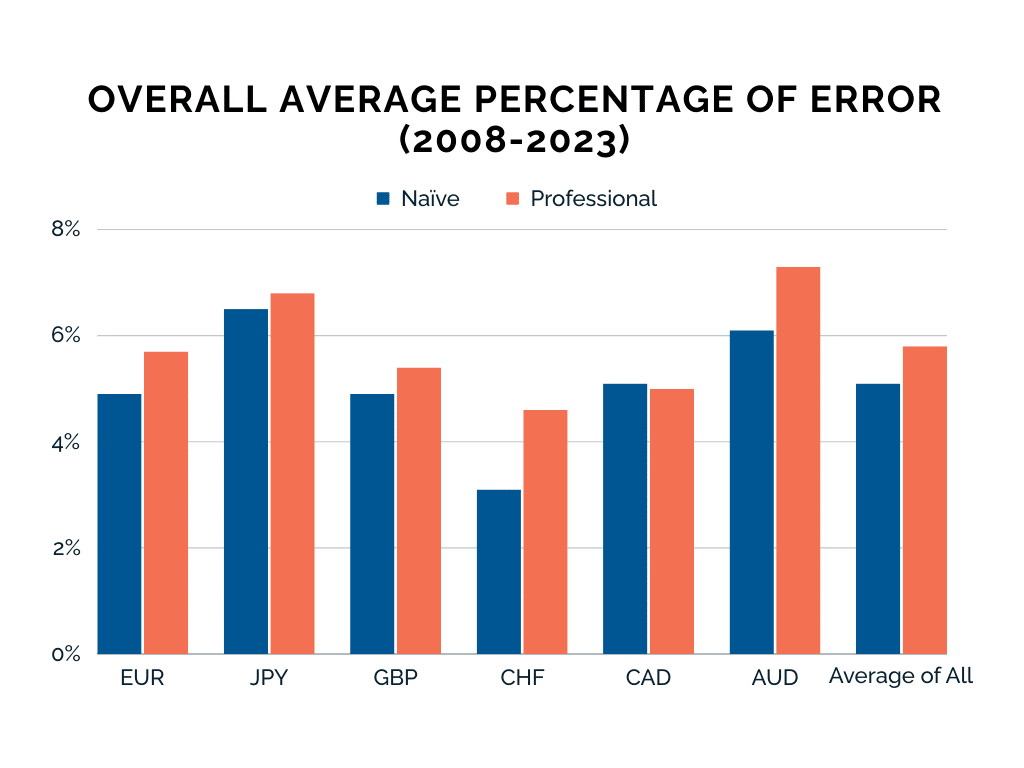

After two straight years of losing to the naïve forecasting method in 2021 and 2022, 2023 saw the professional forecasters eke out a win for the first time since 2020. The result was mostly due to depreciation in the Japanese Yen over the year. However, since Atlas has been keeping track, the G7 forecasting performance has gone handily to the naïve method with the pro’s out forecasting the naïve method in only 5 of the 16 years we have been keeping track. The average forecasting error for the 16-year period is 5.1% for the naïve method and 5.8% for the pros.

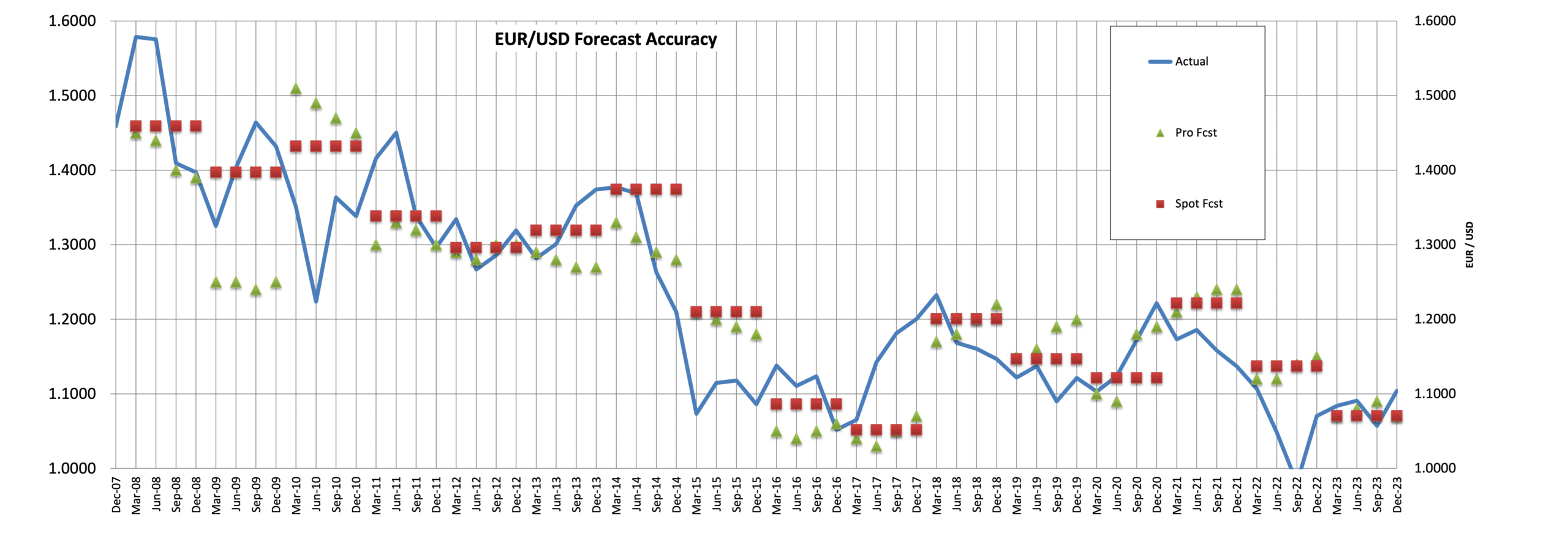

EUR:

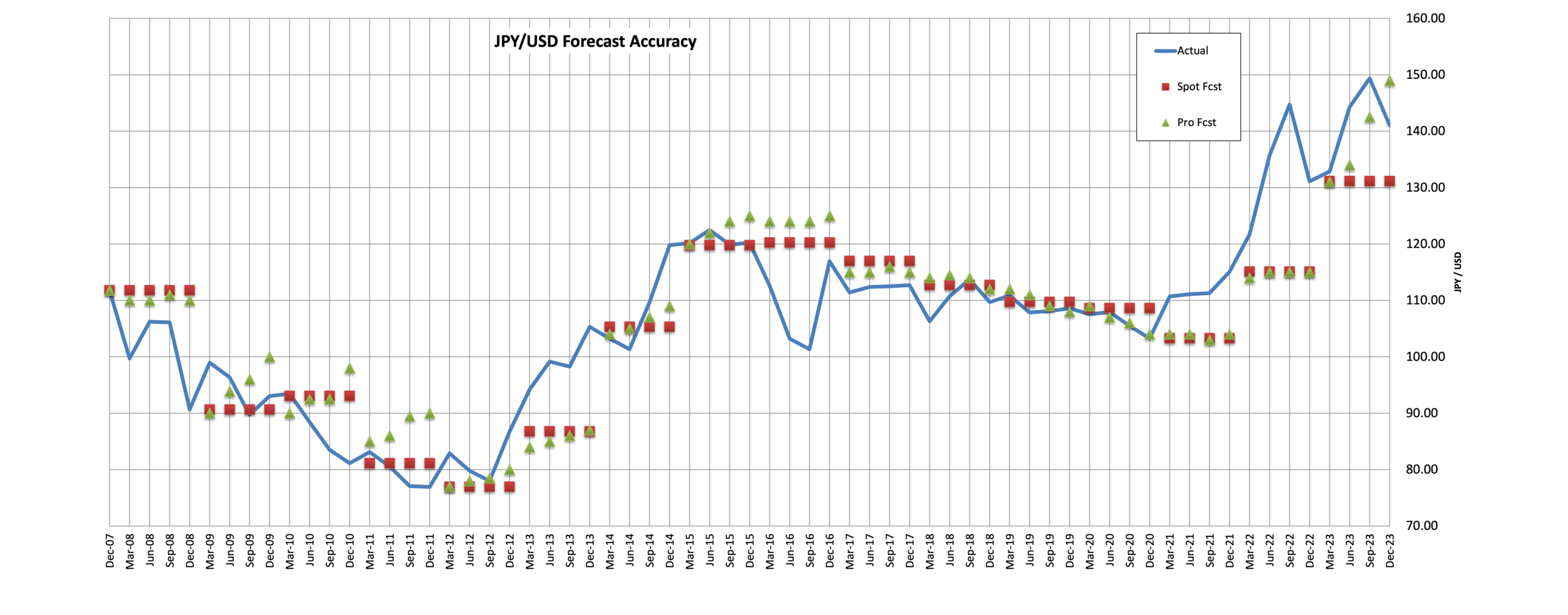

JPY:

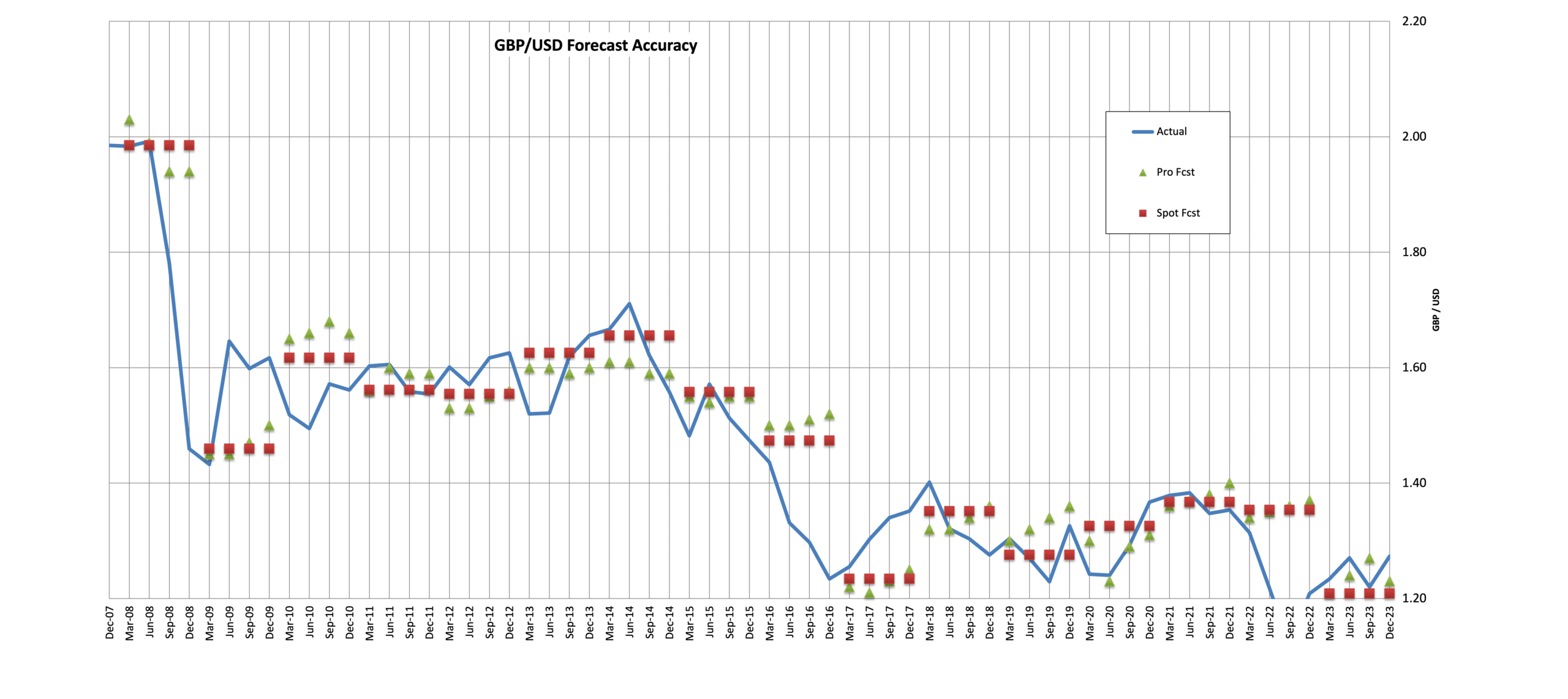

GBP:

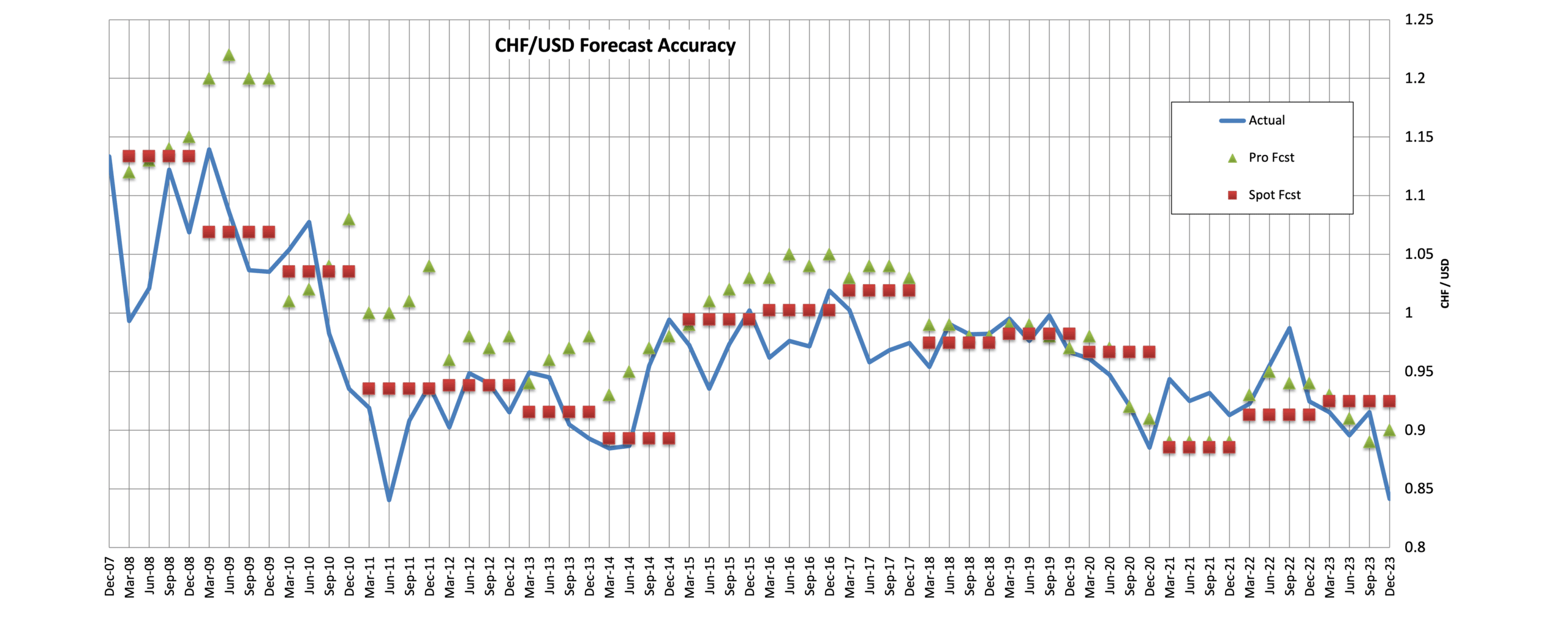

CHF:

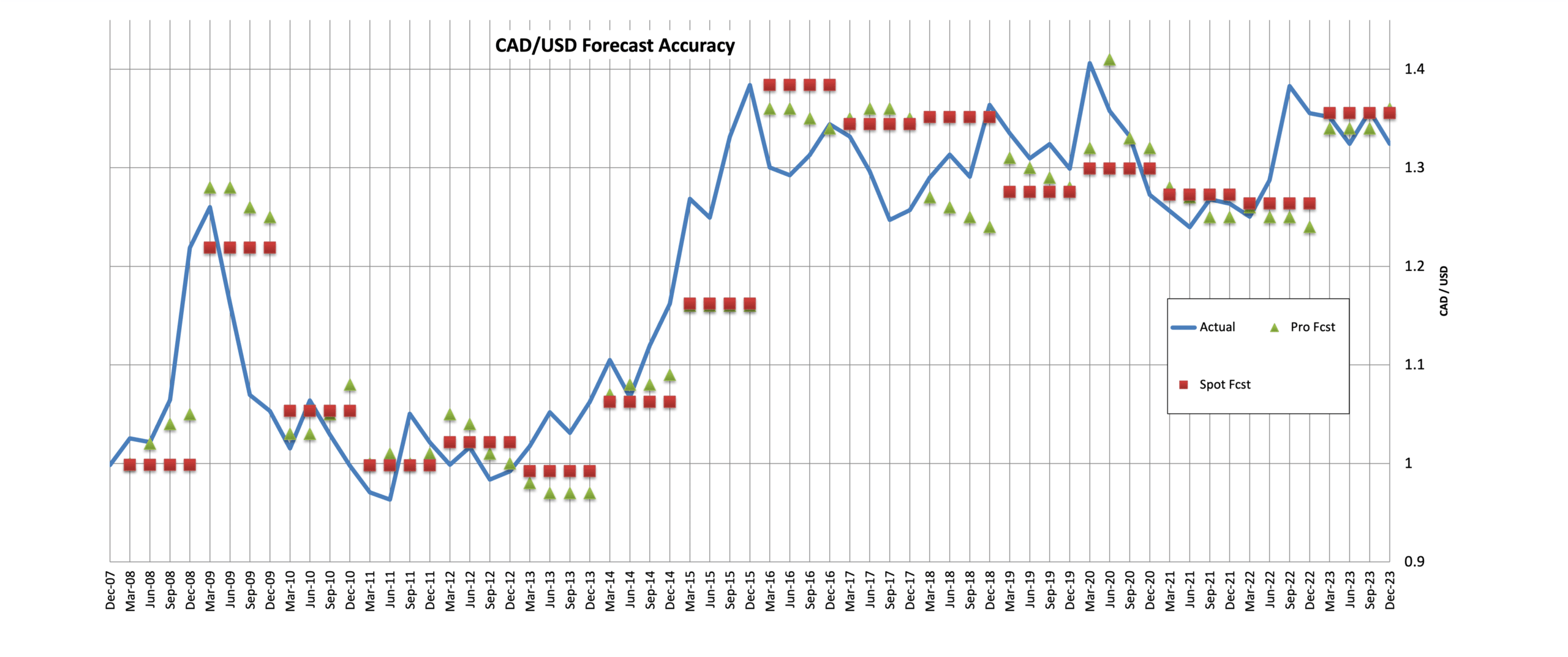

CAD:

AUD:

* Bloomberg Consensus

** Using the spot rate on Dec 31 as the forecast for the following four quarter