Rapidly capture and manage your FX exposures with AtlasFX

Standard ERP summary reports do not contain the transaction currency detail needed to manage your FX risk. AtlasFX, the industry’s only end-to-end cloud-based FX platform, captures and organizes the crucial data with no hassle.

When it comes to managing FX risk –

Getting the right information from your ERP system is crucial. You need a lot of detail, while also keeping the information manageable in order to drive actionable outcomes. With AtlasFX, you will be able to:

- Capture the necessary transaction currency detail.

- Track the difference between daily rate activity and month-end rates.

- Identify “ghost balances” from improperly cleared transactions.

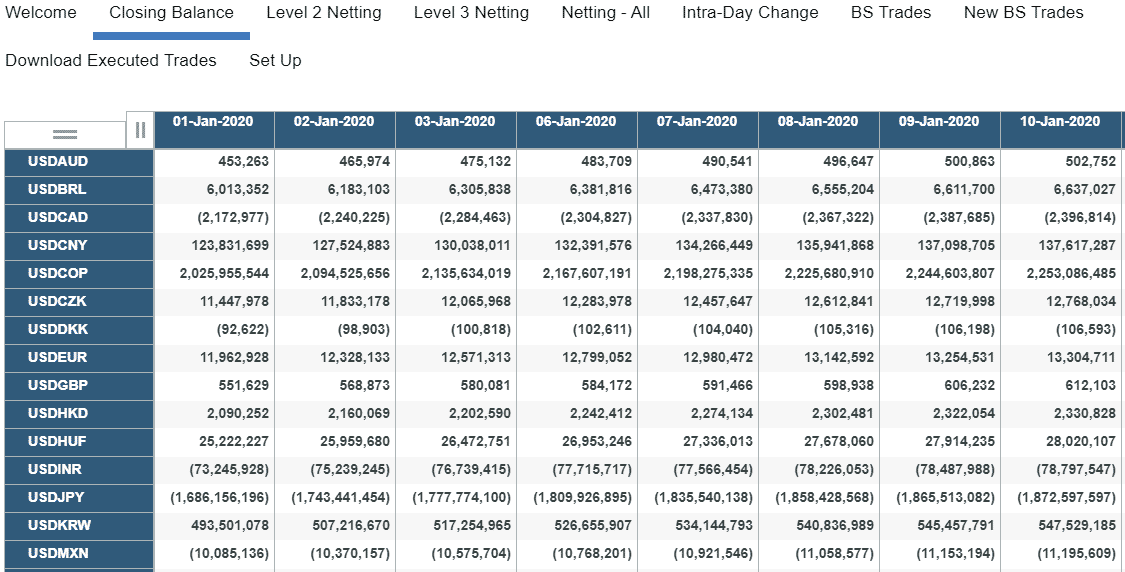

ERP Exposure Capture

Transaction Currency

Get the transaction currency detail you needto understand both your balance sheet and cash flow FX exposures.

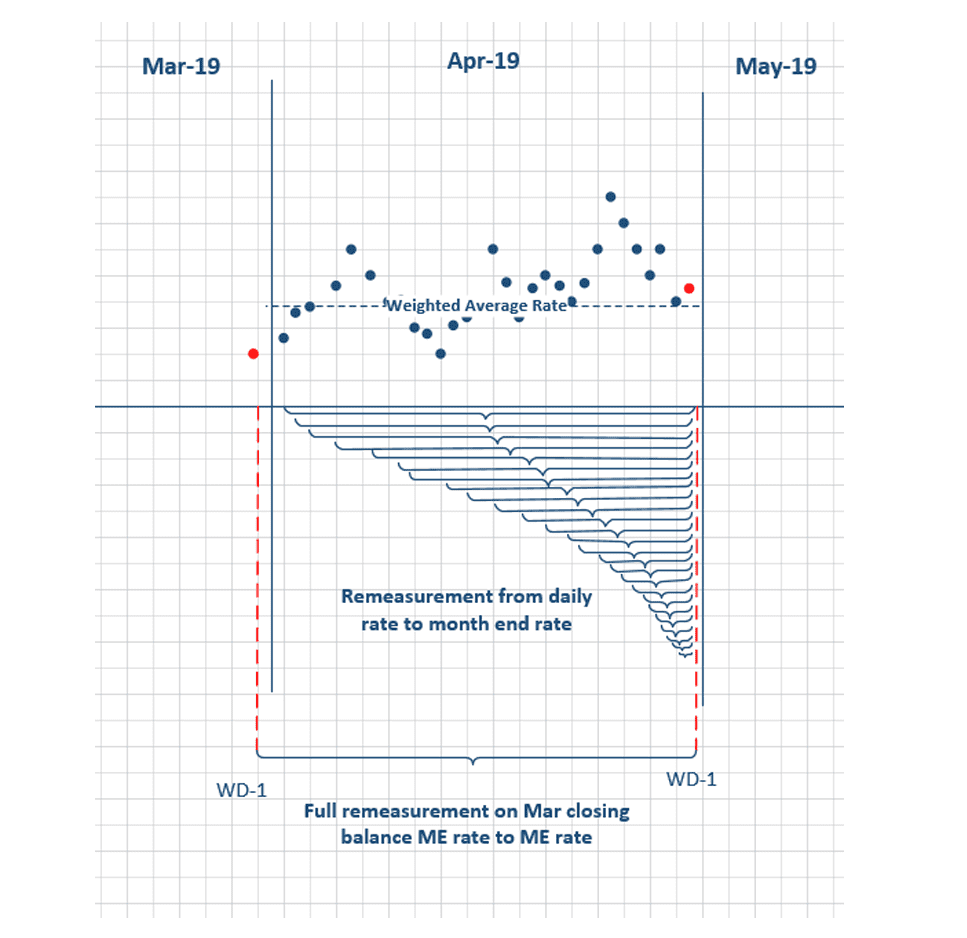

WAR Report

Our “Weighted Average Rate” report allows you to quantify the differences between daily rate activity and month-end rates.

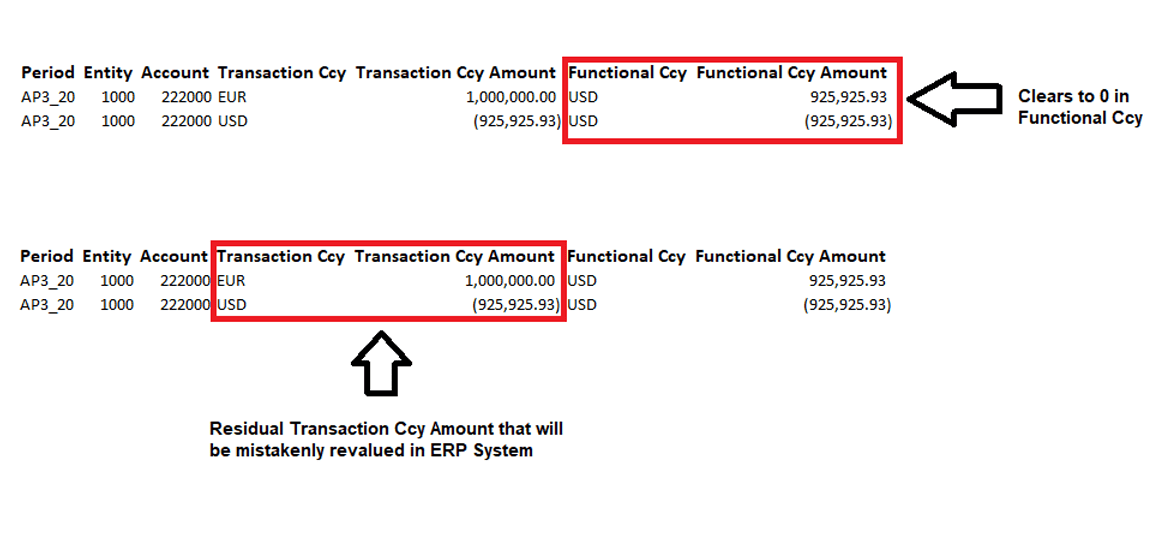

Ghost Balances

AtlasFX can quickly and easily identify “ghost balances” from improperly cleared accounts, allowing for Treasury and Accounting teams to take swift action.

Transaction Currency

The AtlasFX ERP extract pulls the monetary asset and liability accounts from the balance sheet where transaction and functional currencies differ. Additionally, it will pull Income statement data where transaction and functional currencies differ. In cases where the natural account is setup to immediately convert balances into local currency, the query will go down to the lowest level transaction and aggregate values from there. This way, treasury teams will be able to quickly identify all their regardless of account setup.

WAR Report

For companies that utilize “daily” accounting rates, new transactions on the balance sheet are “remeasured” (often referred to as “revaluation” in SAP) from the daily rate on the day that the transaction is booked to the month end rate. When the hedging program is run the following day, the rate at which the new transaction is noticed and potentially hedged will be different (with one day of market volatility).

There are typically 20+ trading days in each financial period so there will be an overall “rate slippage” impact in the gain/loss results for the hedging program. The AtlasFX Weighted Average Rate, or “WAR” report, quantifies this source of FX volatility.

To better understand the implications of various accounting rate setting environments and how to best manage them, see our white paper, “Time to Evaluate Your Accounting Rate Methodology”.

Ghost Balances

Oftentimes, accounting teams will post transactions and clear those very same transactions in differing currencies. On their reporting which only looks at local currency amounts, the transaction appears to be cleared to a zero balance. However, in the underlying ERP system, there is a residual Transaction currency amount. This can be very problematic as the ERP will see this as a valid balance and therefore revalue the amount. This will create false FX gain or loss. Normally, it is a huge headache to find these cases in the sea of millions of transactions posted on a monthly basis. AtlasFX can very quickly and easily identify these ghost balances so that accounting teams can take swift action.